ISLAMABAD: Prime Minister Shehbaz Sharif on Friday hailed the acquisition of First Women Bank Ltd (FWBL) by Abu Dhabi-based International Holding Company (IHC) as a milestone in Pakistan-UAE economic ties, saying the deal would pave the way for more joint ventures and partnerships across diverse sectors.

Speaking at a signing ceremony, the prime minister described the transaction as “the first drop of rain” in a broader effort to deepen economic collaboration with the United Arab Emirates.

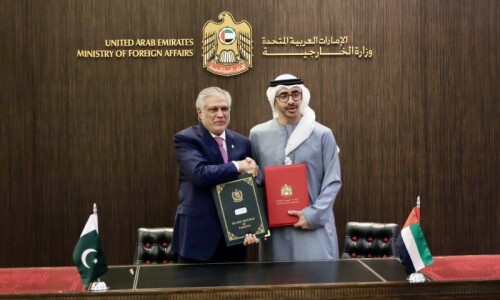

The event marked the official transfer of a majority stake in FWBL to IHC under a government-to-government (G2G) framework. The UAE delegation was led by Sheikh Zayed bin Hamdan bin Zayed Al Nahyan, chairman of 2PointZero.

The federal cabinet had earlier approved the divestment of the government’s entire stake in FWBL, reportedly valued at $14.6 million (approximately Rs4.1 billion), a figure yet to be formally disclosed.

Buyer to inject Rs6.8bn more to meet capital requirements

In addition to acquiring the bank, IHC will meet the total minimum capital requirement of Rs10bn over five years. As of December 2024, FWBL’s equity stood at Rs3.2bn, with the new investor set to inject Rs6.8bn to bridge the gap.

Privatisation momentum

PM Shehbaz attributed the successful closure of the deal to the “determined and focused” leadership of Deputy Prime Minister Ishaq Dar and Adviser on Privatisation Muhammad Ali. He reaffirmed his government’s commitment to restructuring state-owned enterprises and enabling private sector-led economic growth.

He added that FWBL’s founding mission — to support women entrepreneurs — would not only be preserved but also strengthened through professional management and targeted investments in sectors such as agriculture and industry.

IHC sees long-term growth

IHC Chief Executive Syed Basar Shueb said the investment signals confidence in Pakistan’s financial sector and reflects a shared vision for long-term development.

“We see strong potential in the country’s financial sector and look forward to supporting the bank’s modernisation journey by leveraging technology, automating banking processes, and advancing the use of AI in financial decision-making,” he said.

According to an official statement, this marks the first bank privatisation conducted under the Inter-Governmental Commercial Transactions Act 2022. FWBL, established in 1989, currently operates 42 branches across Pakistan, serving retail, SME, and corporate clients.

Published in Dawn, October 18th, 2025