In international trade, the dollar posted a series of multiyear highs after the US Federal Reserve’s hint last week that it might raise interest rates up to three times in 2017, which was more than what some traders had expected.

During the week, the dollar initially climbed to a 14-year high but then declined against a basket of currencies later in the week, as traders booked profits and brushed off mostly upbeat US economic data.

The dollar rally that started six weeks ago has been supported by bets that US President-elect and a Republican-controlled Congress would slash taxes and boost federal spending, resulting in higher growth and inflation.

The greenback has gained 5.1pc since Nov 8 US presidential election

The greenback has gained 5.1pc since Nov 8 presidential election.

In the domestic currency market, the rupee/dollar parity is seen hitting Rs109 mark any time before year end.

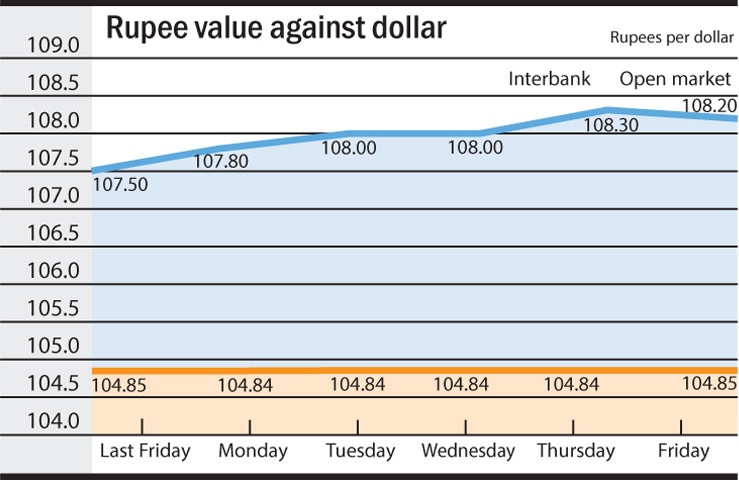

After crossing the Rs108 barrier last week, the rupee is currently trading against the dollar near a four year low. In the past month, it has depreciated by 1.4pc against the dollar in the open market where it is trading higher by Rs3.35 or 3.1pc as compared to the interbank market.

In interbank dealings, the rupee/dollar parity has shown a steady trend since July this year after hitting its lowest level at Rs104.94/95 in January 2016.

Last week on the interbank market, the rupee/dollar parity moved in narrow band as supply and demand for dollar remained in balance amid lacklustre activity in the week.

Trading on a firm note, the rupee commenced the week in plus. After holding firm ground versus the dollar in the next three sessions, the rupee in the last trading session inched down by one paisa and closed the week at Rs104.85 and Rs104.86, unchanged over the prior week close.

In the open market, the dollar turned highly volatile against the rupee in the last week.

Highly bullish dollar in overseas markets, alongside the year end, stepped-up dollar purchases and increased the oil-importer and corporate-demand exerted downward pressure on the rupee.

It is currently trading at close to four year low of Rs108.30/60, near a level last seen on Nov 13, 2012.

Last week in the open market, the rupee commenced the week on a negative note. In the last trading session, however, the rupee managed to stage a recovery against the dollar as it posted a 10 paisas gain that pushed the dollar slightly lower at Rs108.20 and Rs108.50 but still remained close to a four-year low. Since July 2016, the rupee has so far depreciated by 3pc against the dollar.

Against euro, the rupee hovered in the range of Rs112/113 and Rs112.75/114.75 last week.

At the session close, the rupee was trading at Rs112.75 and Rs114.25, its lowest level in the week against euro.

The rupee was seen changing hands at Rs112.60 and Rs114.10 against euro at the close of the week.

Published in Dawn, Business & Finance weekly, December 26th, 2016