KARACHI: The benchmark of major shares sustained its bullish trend on Tuesday and hit yet another high just shy of the psychological barrier of 63,000 points.

Topline Securities Ltd said the upward momentum reflected a boost in investors’ confidence driven by optimistic expectations of an improved economic landscape going forward.

“This positive outlook is supported by anticipated financial inflows from the International Monetary Fund (IMF) and friendly countries,” it said.

Additionally, there’s speculation about a likely reduction in the benchmark interest rate, currently at 22 per cent, in the upcoming meeting of the Monetary Policy Committee (MPC) of the State Bank of Pakistan.

According to a recent poll of key market participants conducted by the brokerage on the monetary policy expectations, 63 per cent of participants anticipated the interest rate would remain unchanged.

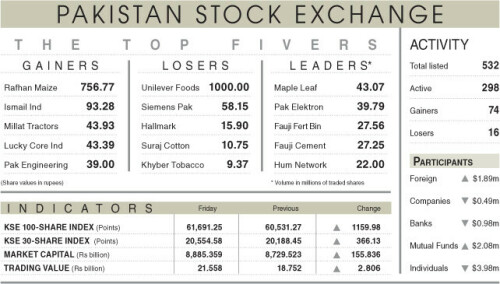

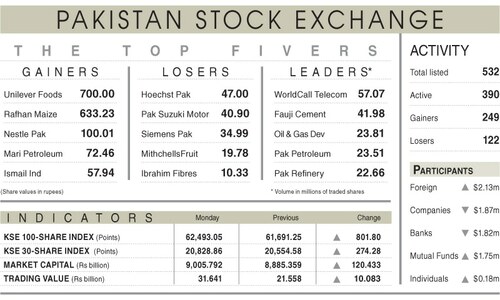

As a result, the KSE-100 index closed at 62,956.03 points after gaining 462.97 points or 0.74pc from the preceding session.

The overall trading volume increased 4.2pc to 765.4 million shares. The traded value decreased 2.4pc to Rs30.8 billion on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (82.3m shares), Pakistan Refinery Ltd (53.7m shares), Fauji Foods Ltd (37.6m shares), Pakistan Telecommunication Company Ltd (36m shares) and Hascol Petroleum Ltd (31.5m shares).

Companies registering the biggest increases in their share prices in absolute terms were Hoechst Pakistan Ltd (Rs76), Pakistan Tobacco Company Ltd (Rs52.70), Reliance Cotton Spinning Mills Ltd (Rs45.45), Pakistan Services Ltd (Rs26.75) and JDW Sugar Mills Ltd (Rs25.01).

Companies registering the biggest decreases in their share prices in absolute terms were the Premier Sugar Mills Ltd (Rs31.25), Millat Tractors Ltd (Rs24.93), Al-Ghazi Tractors Ltd (Rs18.71), Mitchells Fruit Farms Ltd (Rs18.30) and Indus Motor Company Ltd (Rs16.94).

Foreign investors were net buyers as they purchased shares worth $0.93m.

Published in Dawn, December 6th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.