KARACHI: The trading activity on the cotton market on Monday slowed down in line with leading international markets witnessed slump owing to renewed trade tension between US and China.

The slapping of duties by US and China on each other’s imports sent shock waves around the globe as a result all the major markets closed easy under the lead of New York Cotton Exchange. The Chinese and Indian markets were mixed to easy.

According to reports flood water has entered large cotton growing areas of Bahawalpur, Dera Bakhar, and other surrounding areas of river Sutlej and caused extensive damage.

The phutti (seed-cotton) prices declined with Sindh variety was being quoted between Rs3,400-Rs3,700, Punjab type in the range of Rs3,200-Rs3,800 and Balochistan at Rs3,600-Rs3,700 per 40kg.

The Punjab ginners observed partial strike against increase in withholding tax rate from 1 per cent to 4.5 per cent. However, Sindh ginners did not show any interest.

Meanwhile, polyester fibre prices were cut by Rs5 to Rs182 per kg.

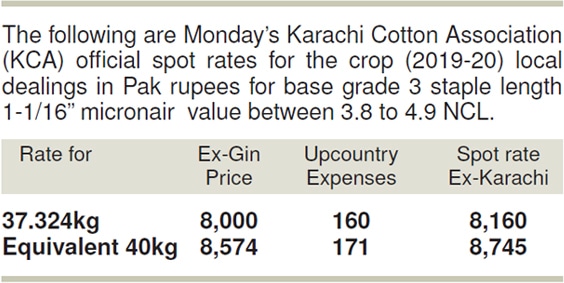

The Karachi Cotton Association (KCA) kept its spot rates at weekend level of Rs8,000 per maund.

The following deals were reported to have changed hands on the ready counter: 1,600 bales, Tando Adam, at Rs7,850 to Rs7,900; 1,000 bales, Shahdadpur, at Rs7,850 to Rs7,900; 1,400 bales, Sanghar, at Rs7,850 to Rs7,875; 1,000 bales, Hyderabad, at Rs7,800 to Rs7,850; 600 bales, Rajanpur, at Rs8,300; 400 bales, Gojra, at Rs8,250; 400 bales, Moongi Bangla, at Rs8,200; and 400 bales, Khanewal, at Rs8,400.

Published in Dawn, August 27th, 2019

Dear visitor, the comments section is undergoing an overhaul and will return soon.