KARACHI: After posting losses overnight, the stock market on Wednesday resumed its upward drive due to political clarity and strong corporate results as investors opted to do some cherry-picking at attractive levels.

Topline Securities Ltd said the equities remained bullish almost throughout the session thanks to further clarity with regards to formation of new government in the centre.

The market witnessed an across the board buying momentum after Moody’s Investors Service maintained Pakistan’s ratings unchanged at ‘Caa3’ with a stable outlook but highlighted that significantly high risks of liquidity and external vulnerability challenges following highly controversial elections, severely constrained decision-making capacity of the coalition government-in-waiting.

Resultantly, fertiliser, cement, bank and exploration and production sectors contributed positively to the index as Fauji Fertiliser Company, Engro Fertilisers Ltd, Lucky Cement, MCB Bank and Oil and Gas Development Company comulatively added 314 points.

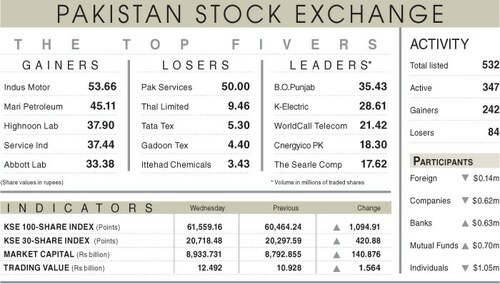

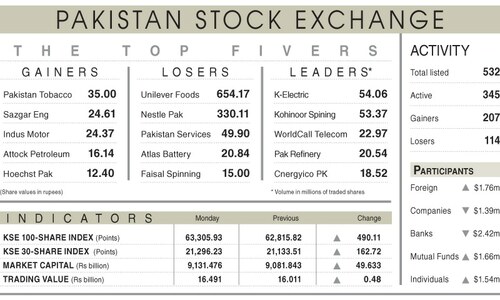

As a result, the KSE-100 index closed at 63,703.45 points after gaining 484.35 points or 0.77per cent from the preceding session.

The overall trading volume rose 12.54pc to 461.39 million shares. The traded value also increased by 9.03pc to Rs16bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (62.18m shares), K-Electric (45.39m shares), Kohinoor Spinning Mills Ltd (23.30m shares), WorldCall Telecom Ltd (21.67m shares), Hascol Petroleum Ltd (30.48m shares) and Pakistan Refinery Ltd (20.72m shares).

Shares registering the biggest increases in their share prices in absolute terms were Unilever Foods Company Ltd (Rs655.00), The Premier Sugar (Rs33.75), Lucky Cement Ltd (Rs24.53), Dawood Larencepur (Rs17.78) and Thal Ltd (Rs15.24).

Companies registering the biggest decreases in their share prices in absolute terms were Pakistan Services Ltd (Rs50.00), Bata Pakistan (Rs25.40), Hoechst Pakistan (Rs21.00), Ferozesons Laboratories (Rs8.70) and Siemens Pakistan Ltd (Rs6.95).

Foreign investors remained net buyers as they picked shares worth $2.95m.

Published in Dawn, February 29th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.