Shares at the Pakistan Stock Exchange (PSX) broke their record breaking streak and fell more than 200 points on Monday, with analysts attributing the sell-off to profit-taking.

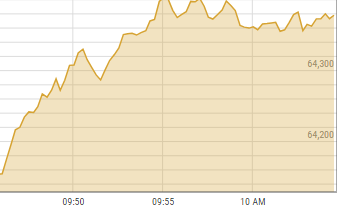

According to the PSX website, the KSE-100 index shed 211.31 points to close at 66,012.32 points, down 0.32 per cent from the previous close of 66,223.63.

It should be mentioned that the KSE-100 index had reached a significant milestone last week as it crossed the psychological barrier of 66,000 points. Overall, the stock market’s benchmark index closed at 66,224 points, up 4,532 points or 7.3pc week-on-week, which was the highest ever weekly pointwise return.

Speaking to Dawn.com, Faran Rizvi, head of equity sales at JS Global, said the market was currently in an “overbought territory” and was likely making corrections.

He predicted a bullish trajectory for the benchmark of representative shares in the near future, with the possibility of the index crossing the 74,000 milestone.

“The market’s focus has now shifted to the upcoming monetary policies, and while most analysts anticipate no change in the current Monetary Policy Statement (MPS), any unexpected adjustment in interest rates — whether upward or downward — could have a significant impact on the market,” Rizvi added.

Meanwhile, Topline Securities chief executive Mohammed Sohail said that the market was witnessing profit-taking, especially from leveraged buyers, after negative news related to refineries.

Capital market expert Mohammad Saad Ali was also of the opinion that the market was responding to “Pakistan State Oil refuting PRL (Pakistan Refinery Limited) divestment and refinery offtake worries”.

“News of Chinese investment in PRL last week drove expectations of a large gain in PSO earnings and expectations of lower cash flow drain for the refinery up gradation. PSO refuted the news over the weekend and thus the stock price is retreating today,” he explained.

Dear visitor, the comments section is undergoing an overhaul and will return soon.