Tax collectors and the business community in Pakistan have a long history of a ‘mutually beneficial’ association.

It is a patron-client relationship that has helped the latter deceive the government with the connivance of the former by concealing exact income and value of wealth in return for cash.

However, this relationship is showing signs of strain of late in the wake of raids made by the tax authorities on business premises’ and attachment of bank accounts of businesspeople, especially in Lahore.

Tax lawyers are of the view that two factors are contributing to the straining relationship between businessmen and taxmen:

First, the Federal Board of Revenue (FBR) field formations have, in recent years, been under immense pressure from the government to collect the increasing tax targets netting more taxpayers.

Second, the tax collectors want to renegotiate their ‘fee’ for protecting the tax dodgers. Background conversations with several businessmen largely corroborate their analysis of the situation.

It was in the middle of May when a manufacturer from Lahore got a call from an LTU (Large Taxpayers’ Unit) official, telling him to write two cheques of Rs2.5 million each:

It is a relationship that has helped the business community deceive the government with help from the tax officials by concealing the exact value of wealth in return for cash

One was meant for the payment of advance tax to be adjusted in his company’s returns for the tax year 2017/2018 and the other for him and his superiors at the FBR as their commission.

The businessman who prefers to stay anonymous for obvious reasons told Dawn that the ‘request’ was accompanied by a veiled threat of a raid on his factory.

“I don’t have anything to hide. But I also know what follows when the taxmen decide to bully you. So I had to oblige and write the cheques as instructed,” he said, throwing his hands up in frustration.

The FBR raids on factories and other business premises peaked during the last quarter (March-June) of 2016/2017 as the drive to collect cash picked momentum to bridge the shortfall in the tax target for the year.

Scores of manufacturing facilities as well as other businesses were searched on allegations of tax fraud, computers and documents confiscated, and owners and senior managers arrested. Tensions grew to the extent where businessmen warned the taxmen to conduct raids at their own peril.

A tax lawyer, Akhtar Naeem, looks at the FBR campaign as a means to extorting money from the taxpayers.

“The FBR people don’t follow the legal procedure — collecting intelligence of tax fraud, obtaining permission from the area magistrate for raiding a business premises, etc — before raiding a business.

“They want to keep their raids off-the-book to allow themselves room for a mutually beneficial deal. But if a deal is not reached, they start harassing the businessmen and confiscate their computers and records.”

FBR officials Dawn spoke with claimed that they had hard evidence of tax evasion and default against the businesses they had raided.

“Our officers don’t carry out raids without solid intelligence of tax fraud. Every business we’ve taken action against was involved in misdeclaration of their tax liabilities. Many of them have finally paid up. Others will,” a senior Inland Revenue Wing official contended.

Speaking on condition of anonymity, he said there was nothing unlawful about the raids and they were authorised by law to search any premises and confiscate the books if the department had information about tax frauds by a business.

Nasir Hameed, a Lahore-based businessman, conceded that ‘some’ businessmen were involved in tax evasion. But he was worried that the (alleged) excesses being committed by the FBR against the businesspeople in the name of catching tax dodgers would further discourage his community from joining the tax system.

“I am not opposed to action against those who steal from the government. But raiding the business premises without following the legal procedures and issuing prior notices is not the right way of doing things.

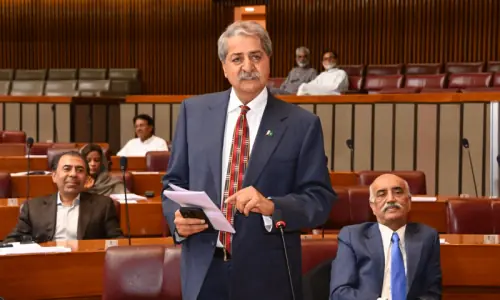

“It is wrong to harass the tiny, existing base of 470,000 taxpayers (excluding salaried people whose taxes are deducted at source) and force them to pay huge bribes to the taxmen and will not get us anywhere,” the vice president of the Lahore Chamber of Commerce and Industry contended.

He argued that the government should widen the tax net instead of further burdening the present taxpayers if it wanted to increase its revenues.

“How long can you make the existing taxpayers pay the bills for running the country? Where is the list of 3.5m (wealthy) people who the FBR claims are out of the tax net? How many have been brought into its net?

“The number of tax filers is shrinking by the day because of highhanded tactics the tax collectors use against the taxpayers. It is also discouraging investment, local and foreign both, in the country.”

Another businessman, who also refused to give his name, was of the view that the problem lay in the country’s unfair tax regime and tax administration.

“Our tax system encourages businessmen to evade payment of their tax and allows the tax bureaucracy to make money at the expense of the government revenue. Both the businessmen and tax collectors are using the system to their advantage.

“Things will have to change if the tax revenue is to rise. A businessman caught stealing from the government should be punished severely.

“But, at the same time, if a tax collector is found having built a false tax fraud/evasion case against any taxpayer or accepting bribes for helping anyone cheat the government, he should also be punished severely and not rewarded.”

Published in Dawn, The Business and Finance Weekly, July 3rd, 2017