KARACHI: Amid anticipation of a sixth straight cut in the interest rate next week, Pakistani shares continued a southward journey despite the resumption of aggressive foreign buying on Wednesday. As a result, the benchmark KSE 100 index tumbled below the 114,000 level due to political and taxation uncertainties.

Topline Securities Ltd Chief Executive Mohammed Sohail said the uncertainty about the new US tariffs and their impact on different companies was taking its toll on the local market. “Moreover, selling by individuals and banks as per National Clearing Company of Pakistan Ltd data putting pressure on share prices,” he added.

However, the global share markets maintained a bullish run for the second straight day despite a raft of trade measures announced by the new US president, particularly on Chinese and European imports.

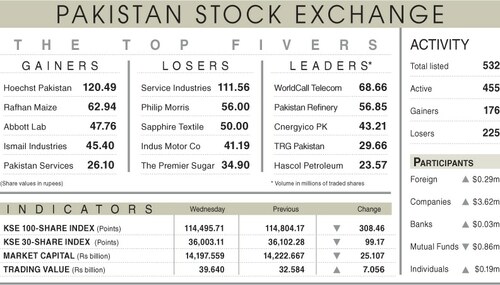

After adding 213 points in initial trade, the benchmark KSE 100 index plunged to an intraday low of 1,682 points, closing at 113,443, down by 1,598 points or 1.39 per cent day-on-day.

Topline Securities noted that the downtrend was primarily attributed to consistent selling pressure from banks, dampening market sentiment and leading to a bearish tone. Investors maintained a cautious stance, which further intensified the negative momentum.

However, Ahsan Mehanti of Arif Habib Corporation said the stock closed bearish amid worries over Tax Laws Amendment Bill 2024 prohibiting non-filers from making stock purchases beyond certain limits.

He added the rupee instability, uncertainty over government-PTI negotiations, and weak global crude oil prices aided bearish activity.

The trading volume dipped 3.08pc to 743.63 million shares, but the traded value rose 10.74pc to Rs35.24bn day-on-day.

Stocks contributing significantly to the traded volume included WorldCall Telecom (100.21m shares), Cnergyico PK (96.97m shares), Fauji Cement (83.55m shares), Bank Makramah (30.54m shares) and Lotte Chemical (21.83m shares),

The shares registering the most significant increases in their share prices in absolute terms were Unilever Foods (Rs349.99), Hoechst Pakistan (Rs183.27), Rafhan Maize (Rs72.66) Pakistan Engineering (Rs67.12) and Nestle Pakistan (Rs23.42).

The companies registering significant decreases in their share prices in absolute terms were Ismail Industries (Rs107.96), Mari Energies (Rs64.55), Sapphire Fibres (Rs42.89), Service Industries (Rs39.52) and Sazgar Engineering (Rs33.95).

Published in Dawn, January 23rd, 2025