The Pakistan Stock Exchange (PSX) crashed on Friday minutes after Prime Minister Shehbaz Sharif announced a 10 per cent tax on large-scale industries.

The bourse stayed flat until two hours after the opening bell. However, at 11:40am, the market witnessed a steep dip with the KSE-100 losing 1,598 points and sinking to 41,100. At 12pm, the benchmark KSE-100 index was down 2,053 points or 4.8pc.

As per the PSX Rulebook, if the index goes five per cent above or below its last close and stays there for five minutes, trading in all securities is halted for a specified period.

The benchmark index closed at 41,149.16 points, down 1,567.81 points, or 3.6pc.

Intermarket Securities' head of equities Raza Jafri cited "massive taxes" as the reason behind the plunge. "The market has reacted very negatively because it will severely hurt corporate profitability," he told Dawn.com.

Ahsan Mehanti of the Arif Habib Corporation concurred. "PSX witnessed massive pressure across the board after PM Shehbaz announced 10pc super tax on industries for one year to bridge the gap in the fiscal deficit," he said.

Khurram Schehzad, CEO of Alpha Beta Core, said that after the government's latest measures, the corporate income tax and investor tax will now exceed 50pc and 55pc, respectively.

"This is the highest not only in this region but in the history of Pakistan. In fact, it is one of the highest tax rates in the world," he pointed out.

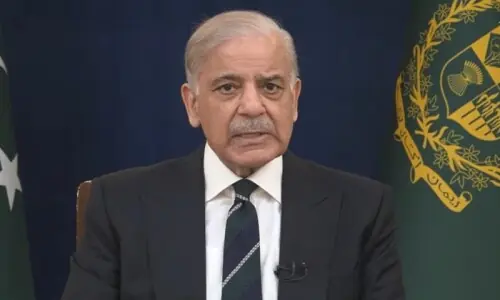

PM announces 'super tax'

Earlier today, the prime minister took the nation into confidence over budget decisions and announced a "super tax" on large-scale industries including cement, steel, sugar, oil and gas, fertilisers, LNG terminals, textile, banking, automobile, chemicals, beverages and cigarettes.

High net worth individuals will also be subject to a "poverty alleviation tax". Those whose annual income exceeds Rs150 million will be subject to 1pc tax; for Rs200 million, 2pc; Rs250 million, 3pc; and Rs300 million will be taxed 4pc of their income.

The premier said the decision was taken to protect the poor segments of the country from rising inflation. "Today, it is time for the affluent citizens to do their part. It is their turn to show selflessness. And I am confident that they will contribute fully to play their part."

He said the institutions whose job to collect tax should take from the rich and give to the poor. However, he lamented that the "big ones" evade paying tax.

PM Shehbaz stressed that it was the collective responsibility of the state — including the PM — that tax money went to the national treasury. "We have been unsuccessful in this so far," he added.

He said: "It is never too late. Right after the budget [is passed], teams have been formed to go all out to collect taxes. Assistance will be sought from all constitutional institutions and we will employ modern technology and digital tools [for the purpose].