ISLAMABAD: Amid government efforts for rightsizing of loss-making entities, the Pakistan Engineering Company Ltd (PECO), a public-listed state-owned enterprise (SOE), has announced a rights issue aimed at restoring the company’s financial health.

A rights issue is when a company offers its existing shareholders the chance to buy additional shares for a reduced price.

According to its website, PECO is an engineering company that manufactures high quality steel re-rolled material and light engineering products, and is controlled by the Ministry of Industries and Production.

In a statement, the company’s board of directors announced that it had approved five years of delayed financial accounts, revealing losses of Rs1.2 billion under the previous regime.

A general body meeting has also been called for Feb 17. The last annual general meeting of PECO was held in Sept 2018.

The company said its new management had worked diligently to reconstruct financial records, rebuild systems, and restore its reputation, which was tarnished by its former managing director — who was a nominee of the Ministry of Industries and Production.

PECO’s board chairman Mirza Mahmood Ahmad said that the company faced years of “catastrophic mismanagement” under its former boss, who remained CEO and MD from 2016 to 2022.

Mairaj Anees Ariff was finally transferred out by the federal government in Sept 2022, and directed to report to the Establishment Division as an officer on special duty.

A move to appoint him as senior joint secretary in the Ministry of Industries was scuttled in March 2024, and he retired from service in Dec 2024.

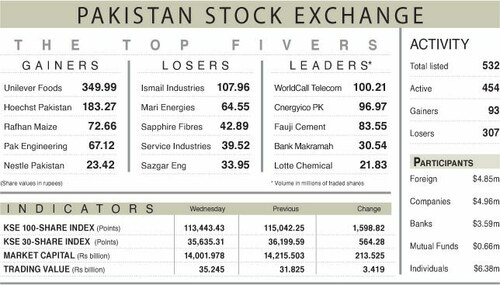

Mr Ahmad said the company’s accounts had remained unaudited for over four years, with no annual general meetings held and no tax returns filed, leading to PECO being placed on the Pakistan Stock Exchange defaulters list and inviting action from regulators such as the SECP.

However, with the approval of an ambitious revitalisation plan, Mr Ahmad said, “today marks a turning point”.

To address the company’s severe liquidity crisis and stabilise operations, the board has now announced a rights issue, aimed at restoring its financial health and providing shareholders with an opportunity to support its turnaround.

The funds so raised will also be utilised to settle overdue liabilities, as the company faces recovery suits from suppliers and financial institutions, a statement said.

Published in Dawn, January 23rd, 2025