KARACHI: The bull market rally continued for the third day flipping the KSE-100 index past the 42,000 barrier at 42,027 points, recording strong gains of 362 points (0.87 per cent).

The benchmark hit intra-day high by 409 points on Wednesday. In the three sessions this week, the benchmark has accumulated an aggregate 1,219 points (3pc). The massive buying by local individuals and institutions drowned the heavy foreign selling of stocks worth $33 million.

The rally at the market has been built on a flow of positive news. The improvement in economic indicators; improved foreign exchange reserves; increase in exports and remittances and ease in inflation to 8.3pc in November, from 8.9pc in October have buoyed investor sentiments.

Flush with cash, there is a dash to put money into stocks where blue chips on several sectors including pharmaceutical, automobile assemblers, cement and technology have dipped to attractive levels.

The exploration & production sector has remained subdued due to uncertainty over the international oil prices. But on Wednesday, the crude started to recover on the news of global pharmaceutical companies Pfizer and Biotech having filed for European approval for their Covid-19 vaccine.

Underpinned by so many positives, the market seemed to shrug off the political rallies and warnings of increasing Covid cases in the country.

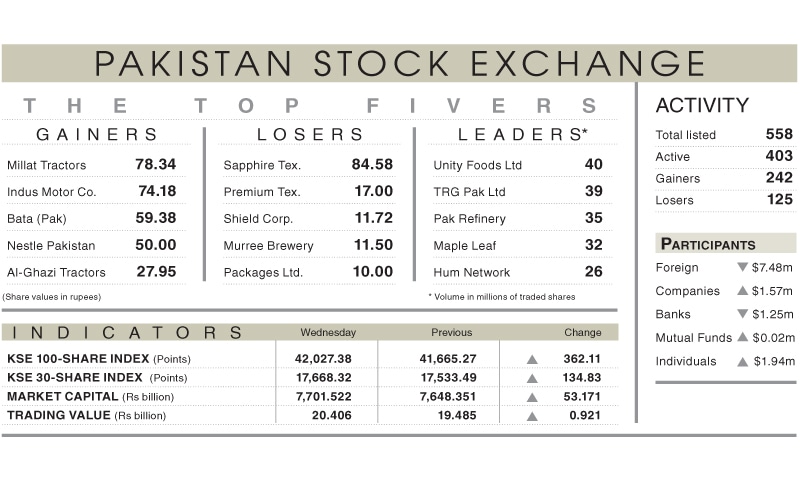

Foreigners’ disposed of stocks worth $7.48m on Wednesday but those were picked up by companies, individuals, brokers’ proprietary trading and insurance companies. Volumes declined from 489.6m shares to 476.9mn shares (3pc day-on-day). Average traded value however, increased by 5pc to reach $127.2mn as against $121.4m. Stocks that contributed significantly to the volumes include Unity Foods, TRG Pakistan, Pakistan Petroleum Ltd, Maple Leaf Cement Factory and Hum Network Ltd, which formed 36pc of the total volumes.

The Hub Power Company (HUBC) gained a day ago on reports of the company having offered the federal government to buy its plant for Rs65 billion. Among scrips, the major support to the index upsurge was provided by Bank Al Habib Ltd 42 points, TRG 41 points, Millat Tractors Ltd (MTL) 40 points, HUBC 24 points and Lucky Cement 23 points. MTL, Netsol and National Refinery Ltd hit upper circuits.

Published in Dawn, December 3rd, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.