KARACHI: Mixed news flow kept the equities market highly volatile, pushing the benchmark KSE 100 index close the outgoing week in the red amid uncertainty about the country’s economic and political outlook.

The investor’s nervousness stemmed particularly after Donald Trump’s inauguration as the 47th president of the United States and a slew of executive orders issued by him, including the imposition of import duties and energy reforms that would have widespread consequences on the global trade equation.

The Pakistan Stock Exchange on Monday, ahead of Mr Trump’s oath-taking, staged a rally, but in the subsequent two sessions turned bearish on selling pressure caused by the proposed tax measures, including restriction non-filers and uncertainty about the outcome of talks between the government and the PTI.

Arif Habib Ltd (AHL) said the market commenced positively amid expectation of further rate cuts in the upcoming State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) meeting next week. However, a brief profit-taking reversed the momentum.

The international oil price witnessed a 3pc week-on-week decline amid concerns over Mr Trump’s plan to boost US oil production. Furthermore, Pakistan has agreed to the $1bn loan terms with two Middle Eastern banks at a high rate of 6-7pc, which would further increase the debt servicing burden.

The expectations of a sixth straight rate cut were strengthened after the government raised Rs326bn against a target of Rs350bn at a T-bill auction on Wednesday. The cut-off yields were slashed by up to 41bps for different tenors at 11.59pc for 3-month, 11.40pc for 6-month, and 11.39pc for 12-month T-bills.

Another positive trigger was the 9.7pc year-on-year increase in textile exports during 1HFY25, settling at $9.1bn. Moreover, the power generation increased by 1pc in December 2024.

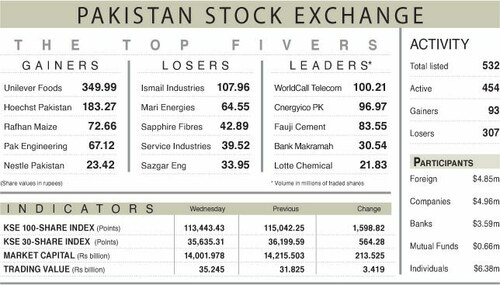

As a result, the KSE-100 index closed at 114,880 points, losing 392 points or 0.34pc week-on-week.

AKD Securities Ltd noted that the market stayed marginally subdued due to the proposed tax amendment bill with increased curbs on non-filers, barring them from purchasing securities, investing in mutual funds and properties, and even suspending their bank accounts.

Regarding economic outlook, the International Monetary Fund revised down Pakistan’s GDP growth forecast to 3pc from 3.2pc for FY25.

On the external front, SBP’s forex reserves declined by $276m week-on-week, settling at $11.5bn. Meanwhile, the rupee weakened marginally against the US dollar, losing 0.015pc week-on-week to close at Rs278.75.

Sector-wise negative contributions came from oil and gas exploration companies (1,225 points), power (194 points), oil and gas marketing companies (114 points), automobile assemblers (81 points) and engineering (33 points). Meanwhile, the sectors that contributed positively were fertiliser (638 points), cement (165 points), pharmaceuticals (74 points), technology (54 points), and chemical (43 points).

Scrip-wise negative contributors were Mari Energies (788 points), Oil and Gas Development Company (198 points), Pakistan Petroleum (198 points), Hub Power (151 points), and United Bank (123 points). Whereas scrip-wise positive contributions came from Fauji Fertiliser (582 points), Fauji Cement (146 points), Meezan Bank (112 points), Systems (76 points), and MCB Bank (46 points).

Foreigners’ buying clocked in at $5.6m compared to a net sell of $9.7m last week. Major buying was witnessed in cement ($3.9m), followed by E&P’s ($1.7m). On the local front, selling was reported by banks ($14.1m) and NBFC ($0.1m). Average trading volume rose 25.1pc to 698m shares while the value traded jumped 7pc to $123.9m week-on-week.

According to AKD Securities, the market will maintain its positive trajectory, driven by an anticipated shift of funds from fixed income to equities amid falling fixed-income yields. With easing inflation, the upcoming MPC meeting on Monday will remain a key focus. Over the medium term, the KSE-100 is anticipated to sustain its upward momentum through CY25.

Published in Dawn, January 26th, 2025