Continuing its upward trajectory briefly, shares at the Pakistan Stock Exchange (PSX) climbed over 1,400 points on Tuesday in intraday trade before plunging more than 1,000 points, which analysts attributed to political noise.

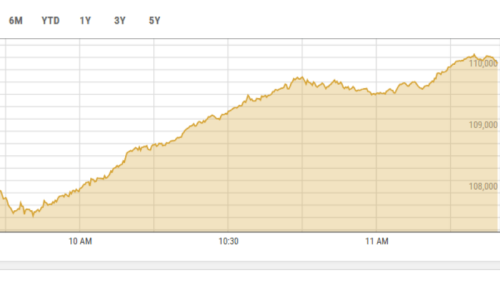

The benchmark KSE-100 index climbed 1,482.06, or 1.35 per cent, to stand at 111,452.44 points at 10:55am from the previous close of 109,970.38 points.

However, later, the KSE-100 closed in red, plunging 1,073.73 points, or -0.98pc from the previous close, to stand at 108,896.65 points from the previous close.

Extensive mutual fund buying during the previous week sent the index soaring by a record point-wise weekly gain of 7,697 points as analysts attributed the rally to lower inflation and positive macroeconomic indicators.

Mohammed Sohail, chief executive of Topline Securities, attributed the initial bullish momentum in today’s session to “non-stop buying by local funds”.

“However, some profit-taking is also seen due to political noise,” he added.

About the initial bullrun, Awais Ashraf, research director at AKD Securities, had said: “Lack of alternative investment avenues in declining commodities and fixed-income yields, coupled with a stable macroeconomic environment, has boosted the appeal of equities.”

Ashraf noted there were expectations of an interest rate cut in the upcoming Monetary Policy Committee (MPC) meeting “amid strong economic indicators”.

“However, banks are likely to remain under pressure until the committee established by the prime minister to reassess the ADR [advance-to-deposit ratio] tax issues its report,” he highlighted.

The State Bank of Pakistan’s MPC is due to meet on December 16 to decide on further interest rate cuts.