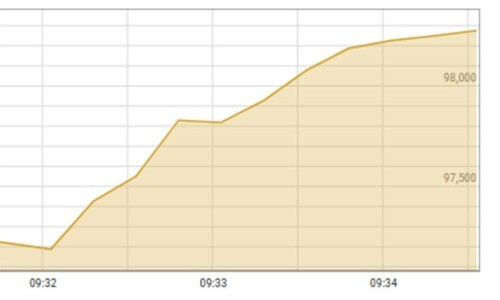

Shares at the Pakistan Stock Exchange (PSX) surged more than 900 points to hit the historic 100,000 milestone on Thursday.

The benchmark KSE-100 surged 947.32, or 0.95 per cent, to stand at 100,216.57 points from the previous close of 99,269.25 points at 9:35am.

Finally, the index closed at 100,082.77, up by 813.52 points or 0.82pc, from the last close.

The record comes two days after the PSX saw brief uncertainty due to political tensions, recovering tremendously the next day as it witnessed the highest single-day gain on Wednesday.

Mohammed Sohail, chief executive of Topline Securities, said, “A remarkable 150pc return from 40k to 100k in just 17 months!”

“New IMF (International Monetary Fund) loan coupled with fiscal and monetary discipline improving investors sentiments,” he highlighted, adding that faster-than-expected fall in inflation and interest rates added cash liquidity to the stock market.

Despite the rally, Sohail noted that the market’s price-to-earnings ratio still traded at 5x compared to the historical average of 7x.

“From less than 1,000 points in the late 1990s to 100,000 today, the market is up 100 times,” he pointed out, adding that this happened after “25 years of ups and downs, bull runs and bear runs, optimism and pessimism”.

“Despite challenges, the market has generated following returns in last 25 years,” he noted, adding that there’s a 20pc annual return in rupee and a 13pc annual return in the greenback which stood as a “testament to resilience and potential”.

Faran Rizvi, head of equity sales at JS Global, said, “In a historic milestone, the KSE-100 has today reached the 100,000 index level, in line with our year-end target.”

He pointed out their target of 100,000 with 60pc return for the index “was premised on a combination of 47pc capital gains and a 13pc dividend yield”.

Yousuf M. Farooq, director research at Chase Securities, observed the index had broken the “psychological barrier of 100,000 points today”, adding that stock market had compounded investor capital at an annual rate of 16 to 18pc historically.

“Periods of prolonged low returns have consistently been followed by phases of significant growth, as seen in previous years,” he highlighted.

Farooq recommended that investors prioritise “long-term compounding rather than being overly concerned about short-term market fluctuations, as even professionals find it difficult to time these movements accurately”.

“At an annual compounded return of 17pc, the PSX could potentially reach 480,000 points by 2034 and an astounding 2,300,000 points by 2044,” he said.

He added, “To put this into perspective, the KSE-100 Index stood near 5,500 points 20 years ago and around 31,000 points 10 years ago.

“Over the past 20 years, investor returns have been approximately 18x, while the past decade has yielded a return of around 3.22x.”

He remarked that the returns were realised “despite facing historically challenging circumstances, including prolonged periods of high inflation, devastating floods, political instability, and multiple currency crises”.

“We believe retail investors should adopt a long-term perspective, investing small amounts of capital monthly in a diversified portfolio aligned with their risk appetite,” he advised, adding that it was critical “to consult a financial advisor to ensure investments”.

Awais Ashraf, director research at AKD Securities, pointed out that “political and macroeconomic stability have driven a significant bull run in the KSE-100 Index, delivering a remarkable 150pc return over the past 18 months”.

He observed that the IMF bailout helped the government stabilise the external account, which contributed to ease in inflationary pressure from 38pc to 7.2pc.

“This improvement allowed the State Bank of Pakistan (SBP) to lower the policy rate by 700 basis points this year while also boosting foreign exchange reserves,” he said.

Furthermore, he highlighted that despite gains, the market remained attractively valued with the price-to-earning ratio of 4.7x — a “considerable discount compared to historical averages and regional benchmarks”.

“Declining fixed income yields, coupled with ongoing macroeconomic stability, strengthen the case for equity investments,” he commented.

PM Shehbaz congratulates nation on milestone

Prime Minister Shehbaz Sharif congratulated the country on the KSE-100 Index surpassing the 100,000 milestone for the first time, state-owned Radio Pakistan reported.

The premier said this “remarkable achievement reflects the trust of business community and investors in government’s policies”.

Shehbaz Sharif said the “government’s economic team and officials working tirelessly to promote investment in the country deserve appreciation for achieving this milestone”.

Furthermore, he promised to take “every possible measure for the economic stability and development of the country”, adding that they “sacrificed their politics to save Pakistan from default”.

“By the grace of God Almighty, the sacrifice has not gone in vain,” he stated, adding that as soon as the “anarchist group left, the positive trend returned to the stock exchange”.

In other positive developments, the premier pointed out that the inflation rate in the country had decreased and the monetary policy rate stood at 15pc, vowing that the government will “continue to work tirelessly for the development of the country”.