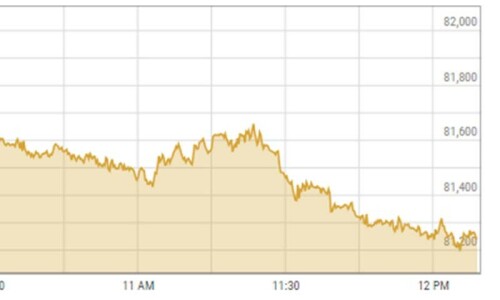

Shares at the Pakistan Stock Exchange (PSX) on Thursday witnessed selling pressure, shedding more than 500 points.

The benchmark KSE-100 index declined by 589.95 points, 0.72 per cent, to close at 81,657.96 points from the previous close of 82,247.91 points.

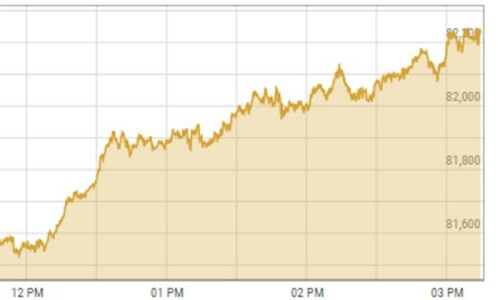

However, it is important to note that the index hit a life-time high in opening trade, rising to a record high of 82,905.73 points before reversing those gains, hours after the International Monetary Fund’s (IMF) board approved a long-awaited $7 billion bailout deal.

Yousuf M Farooq, director research at Chase Securities, said, “Foreign selling from FTSE rebalancing has soaked up local liquidity.”

“IMF deal was expected and built into prices,” he added.

Yesterday, the Fund’s Executive Board agreed to loan Pakistan $7 billion to bolster its faltering economy, approving a relief package that the Prime Minister Shehbaz Sharif-led government has pledged would be the last from the Fund.

Mohammed Sohail, chief executive of Topline Securities, also attributed today’s reversal to “FTSE rebalancing related selling” impacting share prices.

Financial Times Stock Exchange (FTSE) conducts an annual review which classifies country markets as “Developed, Advanced, Emerging, Secondary Emerging or Frontier” within its global equity indices.

On July 3rd, the FTSE reclassified Pakistan from Secondary Emerging to the Frontier market, stating that the country “fails to meet the Minimum Securities Count requirement for retaining Secondary Emerging market status” —with the decision being effective from September onward.

It said the decision was based on the fact that there were “less than two eligible Pakistan constituents of the FTSE Emerging Index as of the assessment date”.

According to an Al-Habib Capital note, “The major contributors to this decline were HUBC, FFC, UBL, ILP and MARI collectively subtracting 428.91 points from the index.

“PIAHCLA was the most actively traded stock, with a volume of 36.33 million shares,” it said.

Additional input from Reuters