KARACHI: Bulls tossed the benchmark index above the 71,000 barrier for the first time in the history of the Pakistan Stock Exchange (PSX) on Tuesday, but the market came under selling pressure, snapping the five-day record-breaking spree amid uncertainty about the outcome of talks with the International Monetary Fund (IMF).

In the preceding session, the index scaled an all-time high on prevailing optimism about the Saudi investment package as a high-level delegation led by the kingdom’s foreign minister arrived last night to expedite the investment commitments.

However, Ahsan Mehanti of Arif Habib Corporation said the index closed in the red due to institutional profit-taking amid uncertainty over the outcome of IMF talks for a new bailout programme and mounting geopolitical tensions.

He said the IMF conditions for tax policy reforms proposing excise duties on industrial units, weak global crude prices and a slump in global equities dampened investor sentiments.

Topline Securities Ltd said throughout the session, the index displayed a mixed performance.

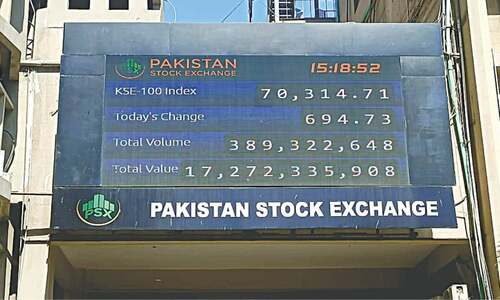

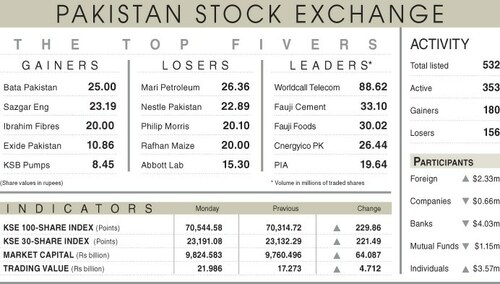

As a result, the benchmark KSE 100 index hit an intraday record high of 71,092.61, gaining 548.03 points, and a low of 70,405.24, losing 139.34 points. However, it closed at 70,483.66 points after losing 60.92 points, or 0.09pc from the preceding session.

Sectors like oil and gas marketing, power generation, fertiliser, and cement contributed to the index’s negative movement. Companies including Fauji Fertiliser Company, Engro Fertilisers Ltd, PSO, Hub Power, and Fauji Cement Company collectively shed 146 points.

However, Habib Bank Ltd, Bank Alfalah Ltd and Mari Petroleum contributed positively, adding 189 points.

The overall trading volume fell 1.22pc to 548.41 million shares. The traded value also dipped 4.33pc to Rs21.03bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (91.61m shares), Kohinoor Spinning Mills Ltd (34.39m shares), Air Link Communication Ltd (19.98m shares), K-Electric Ltd (18.87m shares) and Pakistan International Airlines Corporation Ltd (16.25m shares).

The companies registering the major increases in their share prices in absolute terms were Hallmark Company Ltd (Rs47.97), Mari Petroleum Company Ltd (Rs35.96), Hinopak Motors Ltd (Rs16.61), Philip Morris Pakistan Ltd (Rs15.00) and Al-Abbas Sugar Mills Ltd (Rs10.00).

The shares registering the most significant decreases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs101.00), Allawasaya Textile and Finishing Mills Ltd (Rs97.00), Pakistan Services Ltd (Rs51.44), Ismail Industries Ltd (Rs50.00) and Shahmurad Sugar Mills Ltd (Rs44.86).

Foreign investors continued cherry-picking as they bought shares worth $2.84m.

Published in Dawn, April 17th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.