Bulls maintained their position at the Pakistan Stock Exchange (PSX) on Tuesday as shares gained over 600 points in intraday trade.

The KSE-100 index gained 680.68 points, or 1.05 per cent, to stand at 65,571.18 points at 12:55pm from the previous close of 64,890.50.

Finally, the index closed at 65,502.59, up by 612.09 points, from the previous close.

Faran Rizvi, head of equity sales at JS Global, said that the “current market conditions indicate a consolidation phase within the 63,500 to 66,000 range”.

“Despite short-term fluctuations, our overall market outlook remains bullish, with an optimistic view of favourable trends in the coming days,” Rizvi said, adding that “recent resolution of political uncertainty and promising inflation numbers “serve as positive indicators for an economic upswing”.

He recommended that investors “consider allocating their portfolios toward oil and gas sectors, as well as banking stocks”.

Yousuf M. Farooq, director of research at Chase Securities, said, “The central bank has adopted a more conservative stance by maintaining rates amidst increasing inflation expectations. Additionally, the bank has emphasised that adjustments in administrated energy prices could further elevate inflation.”

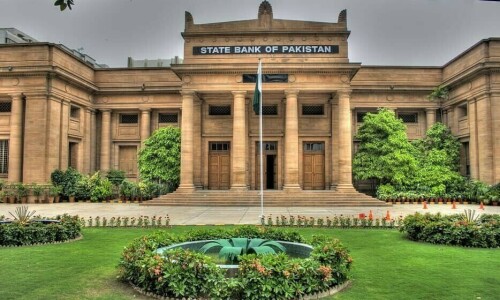

This week, it is worth noting that the State Bank of Pakistan (SBP)’s Monetary Policy Committee (MPC) maintained the interest rate at 22pc, adding that although inflation had declined noticeably, it still remained “high and its outlook is susceptible to risks amidst elevated inflation expectations”.

“These circumstances warrant a cautious approach and continuity of the current monetary stance to bring inflation down to the target range of 5 –7pc by September 2025,” the central bank statement said.

Moreover, Farooq observed that “risks on the political front had relatively diminished” with the new team in the finance ministry appearing to be determined to fulfil the current International Monetary Fund (IMF) programme obligations while also pursuing a longer-term one.

“Projections suggest a decline in inflation figures moving forward, indicating a stabilisation of the economy, a sentiment reflected to some extent in the stock market,” he said, adding that the valuations in the market were notably inexpensive with companies reporting robust earnings growth.

Shahab Farooq, Next Capital Limited, said, “Despite maintenance of status quo in yesterday’s monetary policy — in line with general expectations — the market remains positive today led by expectations of a positive outcome from the meetings with the IMF staff.”

Furthermore, he said that “inflation numbers are expected to come down primarily on the back of high base effect and the interest rates will eventually start coming down in the months to come”.

Dear visitor, the comments section is undergoing an overhaul and will return soon.