KARACHI: The workers’ remittances fell by 10.3 per cent during the first five months of the current fiscal, compared to a decline of 7.3pc in the same period last year.

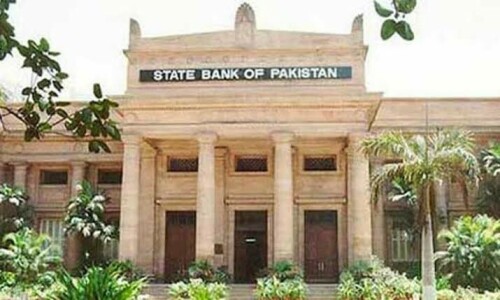

The State Bank of Pakistan’s data released on Friday showed a disappointing figure for the government, which is struggling hard to contain trade and current account decifits along with improving foreign exchange reserves.

During July-Nov FY24, total inflows were $11.045 billion, compared to $12.317bn in the same period of the previous fiscal year, losing $1.272bn. During the entire fiscal year, the country experienced a $4b loss in remittances.

While the government is waiting to get approval from the IMF to receive $700 million as the second tranche of $3bn Standby Arrangement, it lost 1.3bn in remittances.

The SBP stated that in terms of growth, during Nov 23, remittances decreased by 8.6pc on a month-on-month basis and increased by 3.6pc on a year-on-year basis. In Nov 2023, remittances were $2.25bn, compared to $2.17bn in the same month of the previous year, while in Oct 2023, remittances were $2.46bn.

This is also surprising that outflows of Pakistanis during a year were at a record high, and the government finds it hard to meet the demand for passports.

Hundreds of thousands of Pakistanis have left the country for jobs and other purposes, but no change is visible in the inflows of remittances.

The caretaker government has focused on inviting foreign investments up to $100bn in the next five years, but no special strategy has been designed to address the falling remittances. Inflows from exports are also disappointing.

Exporters said that the very high cost of electricity and gas had made them unable to compete in the international market, and the negative impact would be more visible in the second half of the current fiscal year.

The SBP data shows that the highest inflows during the five months were from Saudi Arabia, but it declined by 12.7pc to reach $2.673bn. The second-biggest inflow of $1.906bn was from the UAE, but it also fell by 16.4pc. Inflows from GCC countries declined by 12pc to $1.233bn.

The inflows from the US and UK were $1.312bn, down 4.4pc, and $1.619bn. down 3.6pc, respectively. The EU countries were the only destination from where the inflows noted a growth of 6.6pc to $1.409bn.

Published in Dawn, December 9th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.