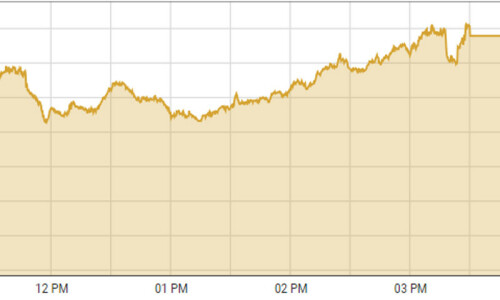

KARACHI: The share market witnessed another positive session on Monday with the benchmark index hitting a six-year high.

The index closed above the psychological barrier of 51,000 points primarily because of the current optimistic market sentiment, said Topline Securities Ltd.

Major sectors that contributed positively to the index rise were oil and gas, fertiliser and automobile.

According to Alpha Beta Core Ltd CEO Ltd Khurram Schehzad, the total value of shares listed on the Pakistan Stock Exchange is hovering around $26 billion versus $100bn back in May 2017 when the index last breached the 51,000-point barrier.

“It’s the value (of shares) that matters to investors, not just the index,” he said, noting that the index rise means investors expect some positive changes ahead.

As a result, the KSE-100 index closed at 51,070.83 points after gaining 338.96 points or 0.67pc from the preceding session.

The overall trading volume decreased 15.3pc to 364 million shares. The traded value increased 9pc to Rs15.9bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Oil and Gas Development Company Ltd (27.5m shares), Pakistan Petroleum Ltd (24.2m shares), Fauji Foods Ltd (19.2m shares), K-Electric Ltd (15.9m shares) and Al-Shaheer Corporation Ltd (15.5m shares).

Companies registering the biggest increases in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs107.50), Sanofi-Aventis Pakistan Ltd (Rs52.50), Blessed Textiles Ltd (Rs26.25), Al-Abbas Sugar Mills Ltd (Rs25) and the Thal Industries Corporation Ltd (Rs20.92).

Companies registering the biggest declines in their share prices in absolute terms were Philip Morris Pakistan Ltd (Rs39.60), Faisal Spinning Mills Ltd (Rs26.62), Bata Pakistan Ltd (Rs10), Sitara Chemical Industries Ltd (Rs5.20) and Service Industries Ltd (Rs5.09).

Foreign investors were net sellers as they offloaded shares worth $0.77m.

Published in Dawn, October 24th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.