KARACHI: The stock market witnessed a positive momentum on Friday on the back of a downward slide in global energy prices as oil and coal rates underwent some correction.

Topline Securities Ltd said the decline in energy prices in the international markets helped the bourse continue the buying sentiment from a day ago. Stocks belonging to the cyclical sectors stayed on the investors’ radar, which helped the benchmark index close at a higher level.

Arif Habib Ltd said investors gained confidence owing to the favourable news with regard to the resumption of the International Monetary Fund’s loan programme. Meanwhile, the rupee further appreciated 0.94pc to 224.04 against the dollar. In addition, the announcements of positive results also triggered higher investor participation. Refinery and cement sectors remained in the limelight, it added.

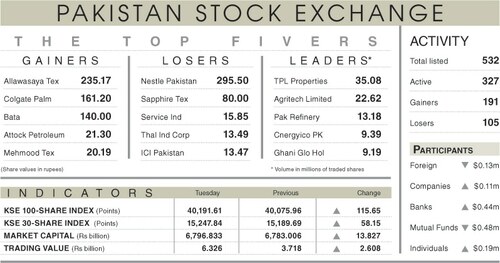

As a result, the KSE-100 index settled at 42,096.24 points, up 670.87 points or 1.62pc from a day ago.

The trading volume increased 47.7pc to 406.7 million shares while the traded value went up 47.2pc to $51.9m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (64.34m shares), Pakistan Refinery Ltd (29.93m shares), WorldCall Telecom Ltd (20.36m shares), TPL Properties Ltd (16.8m shares) and Pak Elektron Ltd (15.93m shares).

Sectors contributing to the index performance included banking (181.8 points), cement (134.4 points), automobile assembling (42.8 points), oil marketing (39.4 points) and power (37 points).

Top advancers in percentage terms were Bawany Air Products Ltd (10.67pc), Dewan Cement Ltd (10.37pc), Cnergyico PK Ltd (10.2pc), B.F. Modaraba Ltd (8.51pc) and PICIC Insurance Ltd (8.43pc).

Top decliners in percentage terms were Cordoba Logistics and Ventures Ltd-R (73.33pc), Tri-Star Mutual Fund Ltd (18.37pc), Huffaz Seamless Pipe Industries Ltd (9.08pc), Bata Pakistan Ltd (7.38pc) and Baluchistan Wheels Ltd (7.35pc).

Foreign investors were net buyers as they purchased shares worth $0.46m.

Published in Dawn, August 6th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.