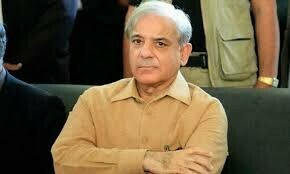

LAHORE: Prime Minister Shehbaz Sharif on Saturday said that the country had the potential to collect revenues of over Rs24 trillion against the annual tax target of Rs9.4tr.

He said that around three times the annual revenue target was ‘going down the drain’ due to corruption, inefficiency, and negligence. This huge amount, he said, could be used to pay debts and construct hospitals, schools, universities, and roads.

Addressing a ceremony to award shields to the honest, hardworking, and efficient officers of the Federal Board of Revenue (FBR), the prime minister said that the time had come to separate whites from blacks and to make decisions of reward and punishment purely on merit, as no nation could develop without strictly following the discipline criteria for government officials.

The premier pointed out that Pakistan was facing multiple challenges, including a low tax-to-GDP ratio and increasing external and internal debts.

As regards the amount worth Rs2.7tr held up across various appellate forums, including commissioners appeals, Appellant Tribunal Inland Revenue (ATIR) and various courts, he said now the law had been made to recover such amounts.

He said that under the new law, the ATIR members, equivalent to the high court judges, would be appointed through an open competition, and their tests and interviews would be conducted by reputable institutions such as LUMS, IBA, etc.

He said those members would also get high perks and privileges equivalent to the senior judges.

Pointing to another Rs756 billion sales tax scam recently uncovered by the FBR, the prime minister said he had directed the authorities concerned to do everything possible to recover the looted money.

Earlier, the prime minister gave away the shields to FBR officers and said that he was proud that the country had plenty of such honest officers who could play their due role in the development and prosperity of the country.

Speaking on the occasion, Finance Minister Muhammad Aurangzeb said revenue collection played a vital role in socioeconomic development and was the key source for running government functions.

He said that policies were formed to broaden the country’s tax base, adding that now it was time to execute these policies with full efficiency, transparency, and honesty to put the national economy on a fast track to economic development and growth.

The minister, while stressing the need to strengthen collection and promote tax culture, said that there were about three million commercial and industrial electricity and gas connections, but only 200,000 of them paid their sales tax.

Published in Dawn, May 5th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.