KARACHI: The Pakistan Stock Exchange observed a positive session on Tuesday as the rupee continued showing resistance against the dollar.

Arif Habib Ltd said the stock market opened in the negative zone but investors opted for value buying during the day, which resulted in the index closing in the green.

The rupee appreciated 0.19 per cent to 238.38 a dollar on a day-on-day basis.

JS Global attributed the positive sentiments on the bourse to the statement by the International Monetary Fund (IMF) resident representative in Islamabad, Esther Perez Ruiz, praising Pakistan for taking all necessary measures ahead of the loan tranche disbursal.

The government has increased the petroleum development levy on retail fuel, which was a precondition of the IMF. The stock market also seemed to react well to the decision by the Election Commission of Pakistan on the foreign funding case of the PTI.

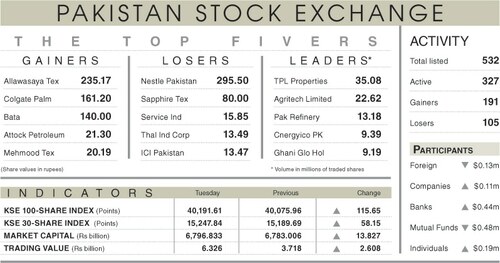

As a result, the KSE-100 index settled at 40,191.61 points, up 115.65 points or 0.29pc from a day ago.

The trading volume increased 97pc to 217.5 million shares while the traded value went up 70.1pc to $26.5m on a day-on-day basis.

Stocks contributing significantly to the traded volume included TPL Properties Ltd (35.08m shares), Agritech Ltd (22.62m shares), Pakistan Refinery Ltd (13.18m shares), Cnergyico PK Ltd (9.39m shares) and Ghani Global Holdings Ltd (9.19m shares).

Sectors contributing to the index performance included fertiliser (73.6 points), chemical (46.8 points), cement (35.6 points), refinery (10.5 points) and automobile assembling (9.1 points).

Top advancers in percentage terms were First Pak Modaraba (10pc), PICIC Insurance Ltd (9.76pc), Safe Mix Concrete Ltd (9.52pc), D.S. Industries Ltd (8.36pc) and Nazir Cotton Mills Ltd (8pc).

Top decliners in percentage terms were Hira Textile Mills Ltd (17.51), Pak-Gulf Leasing Company Ltd (16.23pc), Premier Insurance Ltd (11.38pc), Dewan Textile Mills (10.93pc) and Cordoba Logistics and Ventures Ltd-R (8.45pc).

Foreign investors were net sellers as they offloaded shares worth $0.14m.

Published in Dawn, August 3rd, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.