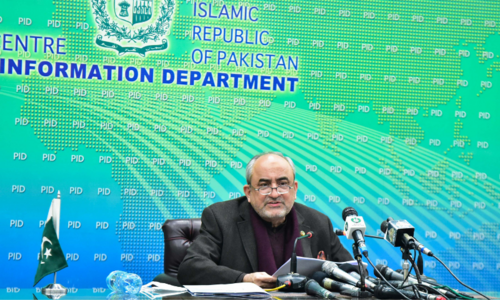

Finance Minister Shaukat Tarin says “we negotiated hard with the International Monetary Fund in the past and it would be done again as the (Fund’s) wish list cannot be implemented in totality,” adding “we have to hold discussions on each issue with them.”

Owing to hard bargaining, the prior action conditions for qualifying for a $1 billion IMF credit facility were softened to some extent. The government is struggling to evolve a strategy to achieve sustainable balanced growth that is inclusive while remaining in the mutually agreed IMF programme.

The IMF credit facility does help borrowing countries to get more foreign debts to tide over the balance of payments difficulties but the underlying problems remain largely unresolved.

As interest rates are rising around the world, the World Bank Chief Economist Carmen Reinhart doubts that G-20 countries could address unsustainable debts of poor states.

Pakistan’s foreign debts are rising fast with multiple adverse impacts and rising risks. In its sixth review of its programme, the IMF staff has revealed that Pakistan would require a record $35bn gross external financing (10.1 per cent of GDP) to bridge the current account deficit and repay its loans in the financial year 2022-23.

Only 7pc of firms in Pakistan raise finance from formal credit lending institutions, according to a World Bank Enterprises Survey

Policymakers including the central bank may pick up some useful ideas for the next round of negotiations with IMF by taking note of the views of Chinese investors and the country’s leading trade bodies to further speed up industrial productivity, boost exports and promote import substitution.

Of particular interest to the policymakers should be a research report entitled ‘Assessment of Monetary Policy Effectiveness in Pakistan’ by the Policy Advisory Board (PABF) of the country’s apex trade body — the Federation of Pakistan Chambers and Industry.

The potential Chinese investors have asked for additional incentives for setting up industrial projects in Rashakai Special Economic Zone. They want exemption of duties on imported raw materials, preferential power tariff, stable power supply and exemption of duties on export tariff for all products of the zone enterprises, especially to Afghanistan.

The Federal Board of Revenue is not in a position to give any incentive in its domain owing to its commitment to the IMF, says an official.

To ease the cost of doing business, concerned authorities have informed the prime minister that 112 out of 167 reforms identified by the Board of Investment for all potential investors in special economic zones have been implemented. The remaining 55 reforms will also clear necessary regulatory approvals within a month.

All potential local and foreign investors (Chinese included) have been exempted from 37 approvals for investment in special economic zones across the country.

Prime Minister Imran Khan has also asked the authorities concerned to immediately resolve all pending issues of the small and medium enterprises sector related to export financing facility, payment of duty drawback on local taxes and levies and financing of banks to address their liquidity crunch.

Here it would be interesting to note that to phase out the refinance facilities the ministry of finance and the State Bank of Pakistan have agreed to jointly design and put in place an appropriate development financial institution by the end of April 2022 (a new IMF structural benchmark). It would be the basis for a plan to transfer refinance schemes to the government.

Referring to the IMF programme, President of the Lahore Chambers of Commerce and Industry (LCCI) Mian Nauman Tanvir says: these measures increased the cost of technology upgradation and hence the competitiveness of our industrial sector.

Since our industries are heavily reliant on imported raw materials and machinery, the abrupt devaluation disrupts the business cycle, Mr Tanvir told the IMF Resident Representative for Pakistan Esther Pervez Ruiz in a meeting organised by the LCCI.

Analysts point out IMF supports erosion of rupee value in spite of the effective exchange rate recorded by the SBP at 96.7pc (lower than 98.5pc in November). The Fund has advised greater exchange rate flexibility to address the balance of payments pressures.

By making exports cheaper and imports costlier, devaluation results in the transfer of capital abroad when the rupee’s value against the dollar is measured by the purchasing parity of the two currencies. It erodes business earnings, savings and investments, resulting in sluggish capital formation in the economy.

Devaluation also contributes to the trade deficit. Mr Tanvir complains that massive and abrupt devaluations have resulted in an exorbitant increase in our import bill with minimal benefit to exports.

The FPCCI Policy Advisory Board has suggested that the market-based flexible rate regime should be replaced with managed float rate in order to avoid imported inflation.

In her remarks at the LCCI meeting, Ms Ruiz said ‘the perspective of the IMF programme is to promote macro-economic stability in Pakistan and to bring a set of policies that can promote sustainable and inclusive policy growth. However, the authors of the ‘Assessment of Monetary Policy Effectiveness’ report (AMPER) disagree.

Pakistan is heading towards stagflation with inflation reaching 11pc in November whereas visible deterioration in key economic indicators has been evident, says the report. The IMF-induced hike in electricity and petroleum prices, interest rate increases and massive devaluation, AMPER contends, would push the economy into stagflation.

Given the moderate economic outlook and deterioration in business confidence, AMPER argues that inflation due to supply side-shock must not be controlled by increasing the policy rate. The government should use prudential regulations to curb demand pulls more effectively. And raising interest rates across the board is unlikely to yield the desired results in curbing inflation.

The policy rate at 8.75pc is in excess of the core inflation rate and well above policy rates of regional peers — China (2.5pc), India (4pc) and Bangladesh (4.8pc). (The core inflation rate was at 7.6pc in November 2021)

According to a World Bank Enterprises Survey, only 7pc of firms in Pakistan raise finance from formal credit lending institutions. Credit to the private sector, as a percentage of GDP, was 17.1pc in 2020 which is the lowest in the regional peers. Around 10pc of the outstanding loans by end of October 2021 were covered under the SBP’s designated fixed rate schemes.

Referring to the World Bank survey, argues the research report, the rising cost of borrowing to curb demand is very unlikely to yield desired results.

Published in Dawn, The Business and Finance Weekly, January 21st, 2022