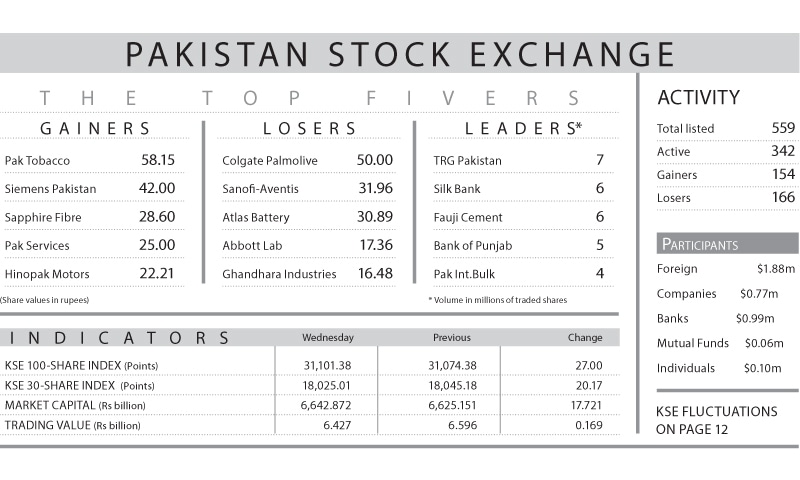

KARACHI: The benchmark KSE-100 index added 27 points to close at 31,101.38 on Wednesday.

The market took off to a blistering start with the index making an intra-day high by 312 points. Recovery in the regional markets gave a boost to investor sentiments.

Yet the gains were wiped out in the second half as investors rushed to book profit since the speculations over potential cut in oil supplies by major exporters to arrest the price decline did not materialise.

Traded volume increased by 11pc to 119.4m shares while value declined 3pc to Rs6.4bn. Volume leaders were mainly the small-cap stocks, except DGKC and FFC.

Director research at Al-Falah Securities, Taha Javed, said that the uncertainty in the regional markets together with the incessant foreign selling had driven investors to the sidelines.

Market participants were also concerned about a potential decline in earnings in major sectors this season, which suggested that investors for the time being preferred to wait-and-watch, instead of taking long positions.

EFOODS dropped 0.8pc as the market thought the results fell lower-than-anticipated.

Analyst Imran Ali at brokerage Invest and Finance Securities observed that in the aftermath of a correction in international oil prices following Tuesday’s rally, volatility persisted in the local market, although result excitement supported the market, keeping the index in green during the session.

Analyst Ahsan Mehanti at Arif Habib Corp said that stocks closed slightly higher led by second- and third-tier stocks amid speculations ahead of SBP policy rate announcements.

Brokerage Sunrise Capital said that the volatility in crude prices was a fear factor for investors.

Published in Dawn, January 28th, 2016

Dear visitor, the comments section is undergoing an overhaul and will return soon.