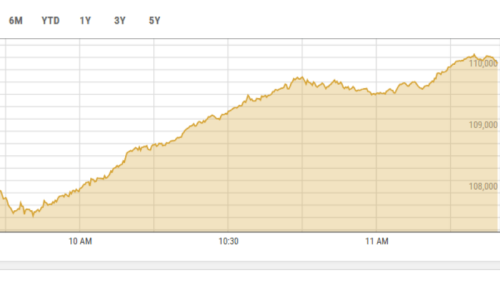

After a day of investors booking profits, bulls returned to the trade floor as shares at the Pakistan Stock Exchange (PSX) surged more than 1,900 points on Wednesday.

The benchmark KSE-100 index climbed 2,026.62 points, or 1.86 per cent, to stand at 110,923.27 points at 1:43pm from the previous close of 108,896.65.

Finally, the index closed at 110,810.21, up by 1,913.56 points, or 1.76pc, from the last close.

Mohammed Sohail, chief executive at Topline Securities, noted that stocks rose again on the back of non-stop buying by local mutual funds after a day of profit-taking.

Yousuf M. Farooq, director research at Chase Securities, said, “The market has rebounded after a minor correction yesterday, following reports that mutual funds invested an additional $10 million in stocks.

“The current rally is being driven by mutual fund inflows, which have been fueled by a sharp decline in interest rates,” he added, adding that the three-month rates have fallen from 20pc in June to around 12pc now.

Awais Ashraf, director research at AKD Securities, said investors were “optimistic about the anticipated policy rate cut and the potential positive outcomes of today’s SIFC [Special Investment Facilitation Council] meeting”.

Experts expect an interest rate cut in the upcoming Monetary Policy Committee (MPC) meeting scheduled for December 16, following inflation falling to 4.9pc, the lowest in 6.5 years.

Moreover, Ashraf highlighted that the “reduction in government borrowing has sparked hope for increased development spending that may spur demand for consumer goods”.

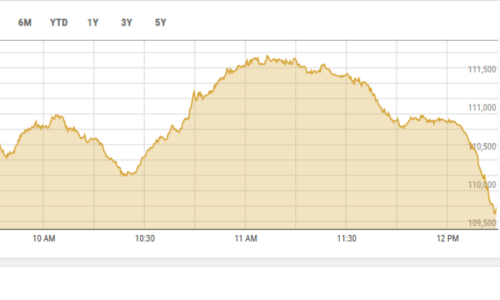

Yesterday, after trading in green initially, stocks snapped a nine-day record-setting streak as the KSE-100 index, after a volatile session, lost over 1,000 points to settle below 109,000 on aggressive profit-taking.

Analysts had attributed the volatility to the global equities downturn on geopolitical tensions in the Middle East and dismal remittances falling by 5pc month-on-month in November.