KARACHI: The stock market extended its overnight losses on Wednesday amid a weaker rupee and contraction in Large-Scale Manufacturing (LSM) production.

Projections of low economic growth and high inflation amid uncertainty about the outcome of the talks for a new IMF loan programme turned equities investors further cautious.

Ahsan Mehanti of Arif Habib Corporation said investors weighed down the dismal LSM numbers, the IMF’s higher inflation projection of 24.8 per cent and subdued economic growth of 2pc for FY24.

As for this fiscal year’s first eight months (July to February), the LSM index shrank 0.51pc year-on-year. The PBS data showed that the cumulative change in the index was negative for the 20th month in a row, i.e. since July 2022.

He added that falling global oil prices impacted the growth outlook, a weaker rupee and ongoing geopolitical tensions contributed to the bearish close.

In the last three sessions of the current week, the rupee depreciated by 46 paise to Rs278.40 against the US dollar in the interbank market amid the State Bank of Pakistan’s dwindling forex holdings following the clearing payment of a $1 bn eurobond, which matured on April 15.

Topline Securities Ltd said equities kicked off the session on a positive note, but at the day’s high, a section of investors indulged in profit-taking in the energy and fertiliser sectors, and as a result, the index closed in the red for the second day in a row.

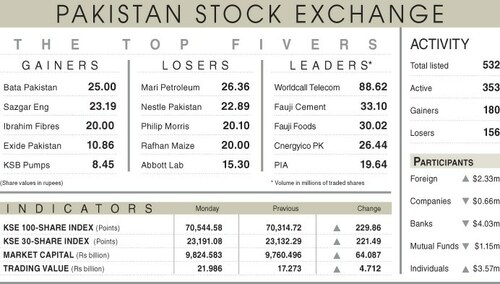

Consequently, the day’s negative contributors were Engro Fertilisers, Oil and Gas Development Company, Engro Corporation, Fauji Fertiliser Company and Pakistan Petroleum Ltd, which wiped out 196 points from the index. On the other hand, Bank Alfalah Ltd, United Bank Lte and Bank Alhabib Ltd attracted buying interest adding 99 points.

As a result, the benchmark KSE 100 index hit an intraday high of 70,725.50, gaining 241.84 points, and a low of 70,037.28, losing 446.38 points. However, it closed at 70,333.31 points after losing 150.34 points, or 0.21pc from the preceding session.

The overall trading volume dipped further by 19.38pc to 442.09 million shares. The traded value also dropped 23.76pc to Rs16.03bn on a day-on-day basis.

Foreign investors turned net sellers as they offloaded shares worth $0.40m.

Published in Dawn, April 18th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.