KARACHI: The rejection of the summary for convening a National Assembly session by President Arif Alvi ended the overnight political optimism for the smooth formation of the PML-N-PPP coalition government in the Centre, as a result the benchmark KSE 100-share index closed the topsy-turvy session in the red on Tuesday.

Ahsan Mehanti of Arif Habib Corporation said stocks remained under pressure amid growing uncertainty over the political outcome of the president’s refusal, which triggered profit-taking by a section of investors.

He said lack of clarity about IMF conditions for a new bailout package, concerns over high inflation and hike in gas prices for industries also contributed to the market’s bearish close.

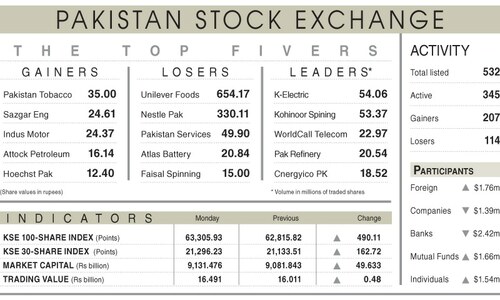

Topline Securities Ltd said throughout the session, the index experienced a mixed pattern, hitting a high of 63,622 and a low of 63,055 levels.

The decline in the index was influenced by Oil and Gas Development Company Ltd, Service Industries Ltd, United Bank Ltd, Pakistan Petroleum Ltd, and PSO, contributing 207 points to the index performance. Conversely, TRG Pakistan, Mari Petroleum Ltd and Kot Addu Power added 113 points cumulatively.

As a result, the KSE-100 index closed at 63,219.10 points after losing 86.84 points or 0.14 per cent from the preceding session.

The overall trading volume dipped by 9.47pc to 409.96 million shares. The traded value also fell by 11.01pc to Rs14.67bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Bank of Punjab(47.57m shares), K-Electric (40.63m shares), WorldCall Telecom Ltd (25.79m shares), Kohinoor Spinning Mills Ltd (23.30m shares) and Pakistan International Bulk Terminal (22.77m shares).

Shares registering the biggest increases in their share prices in absolute terms were Nestle Pakistan Ltd (Rs200.00), Mari Petroleum Ltd (Rs45.21), ZIL Ltd (Rs14.99), Pakistan Services Ltd (Rs14.90) and Sitara Chemical Industries (Rs11.00).

Companies registering the biggest decreases in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs339.00), Hoechst Pakistan Ltd (Rs61.40), Service Industries Ltd (Rs50.25), Pakistan Tobacco Company Ltd (Rs30.00) and Blessed Textiles Ltd (Rs24.52).

Foreign investors remained net buyers as they purchased shares worth $0.71m.

Published in Dawn, February 28th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.