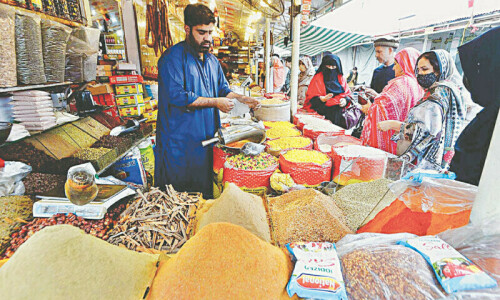

ISLAMABAD: Headline inflation accelerated for the second consecutive month in December, rising to 29.7 per cent year-on-year from 29.2pc in the previous month, primarily due to soaring prices of essential kitchen items and electricity rates.

In December, power rates saw a 15.76pc increase, LPG rose by 2.62pc, and the 520pc spike in gas prices in November further contributed to inflation. Vegetables such as tomatoes, onions, and potatoes experienced an increase from the previous month.

The first-half inflation for FY24 was recorded at 28.79pc, compared to 25.02pc during the corresponding period last year. This inflation rate exceeds the government’s projection of 21pc.

The IMF has also forecast the average inflation for FY24 at 25.9pc, a significant easing from the previous year’s 29.6pc. The month-on-month inflation rose 0.8pc, Pakistan Bureau of Statistics reported on Monday. The inflation rate was recorded at 24.5pc in December 2022.

The headline consumer inflation, measured by a basket of goods and services called the Consumer Price Index (CPI), has been elevated since mid-2022 after the PML-N-led coalition government took several measures demanded by the IMF to unlock stalled funding.

The goods and services in the CPI basket are divided into 12 major components with different weights. The indexes for the two groups with the highest weight — “food and non-alcoholic beverages” and “housing, water, electricity, gas, and fuels” — both saw an annual increase of over 30.93pc and 45.34pc, respectively, in December.

Food, core inflation

Food inflation for December stood at 28.8pc in urban areas and 29.3pc in rural areas, whereas non-food inflation was 32.4pc in urban areas and 26.4pc in rural areas.

Core inflation, which strips out volatile food and energy prices, remained almost steady at 18.2pc in urban areas compared to 18.6pc last month. In rural areas, core inflation was recorded at 25.1pc, down from 25.9pc.

Main contributors

In urban areas, the food items whose prices saw the highest annual increase in December included fresh vegetables (65.41pc), wheat flour (59.03pc), sugar (49pc), potatoes (46.76pc), rice (45.60pc), pulse mash (43.70pc), wheat products (38.94pc), tea (37.77pc), pulse masoor (32.29pc), wheat (29.04pc), eggs (26.76pc), milk fresh (21.77pc), tomatoes (20.96pc), fish (20.29pc), meat (17.42pc), chicken (17.07pc), pulse moong (12.77pc), gram whole (11.98pc), pulse gram (3.90pc), fresh fruits (3.19pc) and cooking oil (2.58pc).

In the non-food category, gas charges rose 520pc, followed by electricity charges (61.60pc), transport services (38.25pc), drugs and medicines (32.42pc), doctor (MBBS) clinic fee (25.10pc), hospitals services (23.52pc), motor fuel (22.50pc), motor vehicles (21.90pc), construction input items (20.26pc), solid fuel (19.40pc), dental services (17.99pc), water supply (16.03pc), medical tests (15.23pc), tailoring (14.48pc), construction wage rates (12.72pc), education (12.66pc), household servant (12.20pc), postal services (11.46pc) and house rent (5.64pc).

In rural areas, the highest annual increase was seen in the prices of food items like fresh vegetables (77.64pc), wheat flour (59.53pc), potatoes (51.24pc), rice (50.68pc), tea (49.42pc), sugar (48.69pc), wheat products (45.92pc), pulse mash (45.11pc), wheat (29.53pc), milk fresh (24.58pc), pulse masoor (23.35pc), eggs (22.87pc), meat (22.58pc), fish (22.34pc), chicken (20.64pc), tomatoes (12.73pc), fresh fruits (12.46pc) and pulse gram (2.49pc).

In the non-food category for rural areas, the prices of electricity charges (61.60pc), transport services (58.18pc), water supply (31.65pc), motor fuels (24.44pc), drugs and medicines (21.79pc), doctor clinic fee (20.04pc), tailoring (19.72pc), household textiles (19.52pc).

Published in Dawn, January 2nd, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.