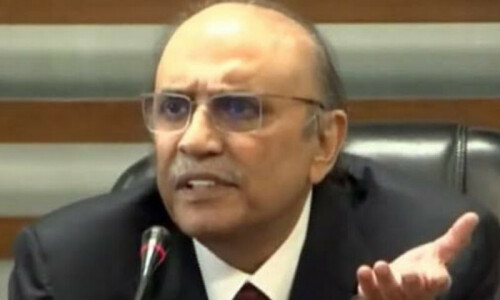

The tax and expenditure changes made by Finance Minister Ishaq Dar in the budget for the next fiscal year — aimed to slash the fiscal deficit from the targeted 6.54 per cent of the GDP — are believed to have narrowed differences between Pakistan and the IMF, bringing the PML-N-led coalition government closer to clinching the bailout deal that has been in limbo over the last seven months.

Nevertheless, some uncertainty continues to surround the ongoing discussions between the two sides on the other conditions the lender has put forth for the restoration of its funding programme, which will unblock billions in stalled loans from other multilateral and bilateral lenders.

The fiscal tightening changes announced on Saturday were the outcome of three days of marathon negotiations with the lender of last resort, in a last ditch attempt to revive the funding package before it expires on June 30.

But while the minister announced additional Rs215bn in new taxes and a spending cut of Rs85bn to reduce the fiscal deficit, he didn’t say a word on whether the differences on the IMF estimate of the external financing gap of $6bn for the current financial year had been bridged or not.

“Though the details of how the additional tax revenues of Rs215bn will be generated are not clear, the minister has said it will not affect common people. So I believe [these taxes] will be levied on the rich,” Topline Securities CEO Mohammad Sohail told Dawn.

He expressed the hope that the changes in the budget “may convince the IMF to restart the funding programme”, but also had a word of caution regarding the IMF’s stance on the country’s external financing gap of $6bn.

Pakistan doesn’t agree with the IMF on its external financing gap projections, maintaining that it had been lowered by a sizeable reduction in the current account deficit due to controlled imports. The government has already arranged $4bn from Saudi Arabia and the UAE to fill the remaining hole.

The unannounced controls on foreign exchange rates also remain a bone of contention between the lender and Pakistan, since Mr Dar is a vocal advocate of a strong rupee. The tax amnesty announced for those who bring back home $100,000 was also criticised by the IMF, as it is believed to be against the programme’s conditions.

The budget review comes on the heels of a meeting between Prime Minister Shehbaz Sharif and IMF Managing Director Kristalina Georgieva, on the sidelines of a Global Financing Summit in Paris.

In her comments on the original finance bill presented by the government on June 9, the Fund’s resident representative in Pakistan had said the budget “misses an opportunity to broaden the tax base in a more progressive way”.

But Arif Habib Ltd CEO Shahid Ali Arif was quite optimistic about the finalisation of a deal with the Fund. “We still have a couple of days to sort out whatever gaps are left. Based on the progress made so far, there is a possibility that the IMF may conclude the ninth review and release the long-awaited tranche of $1.2bn,” he argued.

He said a lot of progress seemed to have been made over the past three days, as was evident from the review of the tax target and the reduction in spending.

“Obviously, the IMF must have asked for more. It would have been great if the government had agreed to reduce its development stimulus, but the fiscal tightening announced by the minister has already helped slash the fiscal deficit for next year by Rs300bn, which is a significant step forward.”

He was also hopeful that the lender would review its stance on its estimates of the external financing gap for the present fiscal year, to pave the way for the revival of the suspended programme before the end of this month.

Mr Arif said the deal with the IMF was crucial for unlocking assistance from other multilateral and bilateral lenders. “Once the deal is closed and the IMF comes on board, it will unclog the pipeline, improve dollar liquidity and ease pressure on rollovers,” he concluded.

Published in Dawn, June 25th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.