Oil prices rose on Wednesday after data showed US inventories and fuel supplies tightening and following a warning from the Saudi energy minister to speculators raised the prospect of further OPEC+ output cuts.

Brent crude futures rose 88 cents, or 1.2 per cent, to $77.72 a barrel by 08:37 GMT, while US West Texas Intermediate crude (WTI) gained 98 cents, or 1.3pc, to $73.89 a barrel.

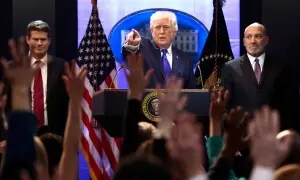

Saudi Arabia’s energy minister said short sellers — those betting that prices will fall — should “watch out” for pain.

Some investors took that as a signal that the Organisation of Petroleum Exporting Countries and allies including Russia, also known as OPEC+, could consider further output cuts at a meeting on June 4.

“Oil prices are trading higher… buoyed by the latest short-seller warning from Saudi Arabia,” said OANDA market analyst Craig Erlam.

“(But) if past experience is anything to go by, traders may be tempted to call his bluff.”

Also boosting oil prices was industry data which showed that US crude oil and fuel inventories fell sharply.

Crude inventories fell about 6.8 million barrels last week, according to market sources citing American Petroleum Institute (API) figures. Gasoline inventories dropped about 6.4 million.

If data from the Energy Information Administration (EIA), due on Wednesday, confirm these figures, US gasoline inventories would have declined for the third consecutive week to their lowest pre-Memorial Day levels since 2014.

The Memorial Day holiday in the United States, this year on May 29, traditionally marks the beginning of US peak summer travel and higher fuel demand.

Weighing on broader markets, another round of debt ceiling talks ended on Tuesday with no signs of progress as the deadline to raise the government’s borrowing limit or risk default ticked closer.