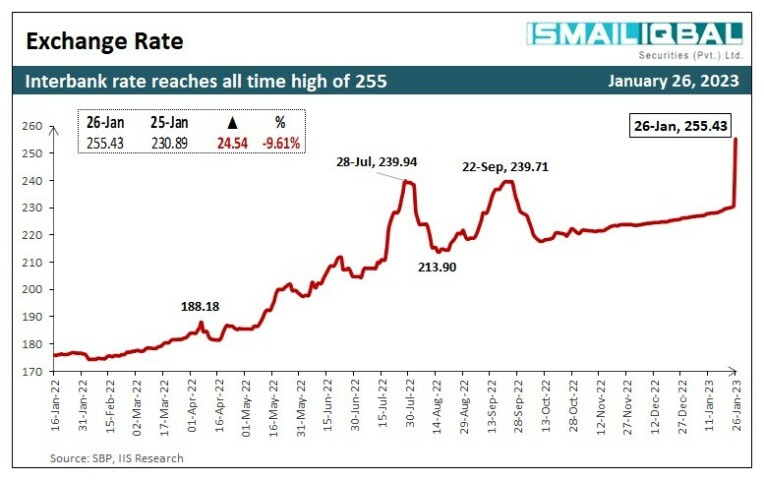

The Pakistani rupee plunged to a record low of Rs255.43 against the dollar in the interbank market on Thursday, sliding Rs24.54 or 10.63 per cent from yesterday’s close, after the removal of an unofficial price cap on the exchange rate.

Ismail Iqbal Securities’ Head of Research Fahad Rauf said it was the largest single-day decline in both absolute and percentage terms since the introduction of the new exchange rate system in 1999.

Separately, the PKR was being traded at Rs255 per dollar — also a record low — in the open market around 11:40am, according to data from the Forex Association of Pakistan. This equates to a depreciation of Rs12 or 4.94pc over yesterday’s rate of Rs243.

As a result, the difference in rates between the interbank and open markets, which had widened to Rs15 in recent months, was almost wiped out.

Topline Securities CEO Mohammad Sohail termed it a “much-awaited adjustment” that allowed banks to quote an exchange rate based on demand and supply in the market.

He noted that the country adhered to a market-based exchange rate till September last year. However, afterwards the interbank rate was kept within a narrow band that gave rise to a grey market, he added.

“Now the grey market rate will come closer to the interbank rate. This will help in increasing exports and inward remittances through banking channels. This may also help in reviving the delayed ninth review with International Monetary Fund (IMF) and inflows from friendly nations.”

Director of financial data and analytics portal Mettis Global, Saad bin Naseer, said the State Bank of Pakistan’s (SBP) move to allow the dollar to appreciate was a “very good thing” for the market. However, there were no sellers, only people looking to buy the greenback at the moment, he added.

Naseer noted that one of the main requirements to complete the ninth review of the IMF programme, which would unlock $1.2 billion, was adherence to a market-based exchange rate.

After the move to lift the rate cap, inflows were expected from the IMF and elsewhere, Naseer said.

“Wider spreads between interbank and grey markets created pressure on the interbank market. This is a step closer to meeting the IMF’s condition,” said Komal Mansoor, head of strategy at Tresmark.

Meanwhile, Exchange Companies Association of Pakistan (Ecap) Chairman Malik Bostan said commercial banks were not supplying dollars to exchange companies despite the SBP’s directives. “The cap on the dollar rate has been removed which is why it is appreciating. It can continue to rise till supply resumes.”

He urged the SBP to ensure commercial banks supplied dollars to exchange companies.

Price cap lifted

Foreign exchange companies lifted a price cap on the dollar on Wednesday, saying it had caused “artificial” distortions and created a black market, where the US currency was selling at higher rates. As a result, the rupee depreciated to Rs252.5 in early open-market trade.

However, within an hour of the implementation of the unprecedented decision by exchange firms, the SBP swung into action and crushed the move, forcing exchange companies to bring down the initial price of Rs252.5 to Rs243.

Before the cap on the rupee was removed, markets eyed three different rates to assess its value — the SBP’s official rate, the one assessed by the foreign exchange companies and the black market rate.

Shortly after taking over in September last year, Finance Minister Dar had termed the PKR’s depreciation against the US dollar “the mother of all evils” and introduced a host of administrative measures in collaboration with the central bank to keep the exchange rate in check.

However, as the country’s foreign exchange reserves declined rapidly, the financial sector had urged Dar to stop ‘managing’ the rupee-dollar parity, which is one of the key conditions set by the IMF for resuming stalled talks.

Dear visitor, the comments section is undergoing an overhaul and will return soon.