KARACHI: Bulls made a comeback to the Pakistan Stock Exchange on Tuesday after a major drop in share prices a day ago owing to the unexpected increase in the key interest rate.

The index moved in the positive zone throughout the trading session as investors’ sentiments improved after the government received $500 million from Asian Infrastructure Investment Bank, said Arif Habib Ltd.

The inflow of dollars helped calm investors’ nerves as the country is supposed to pay back its international sukuk worth $1.08 billion in the coming days.

Investors’ participation remained active throughout the day with third-tier stocks witnessing the highest activity.

“Going forward, we recommend that investors should adopt a buy-on-dips strategy in banking and technology sectors,” said JS Global.

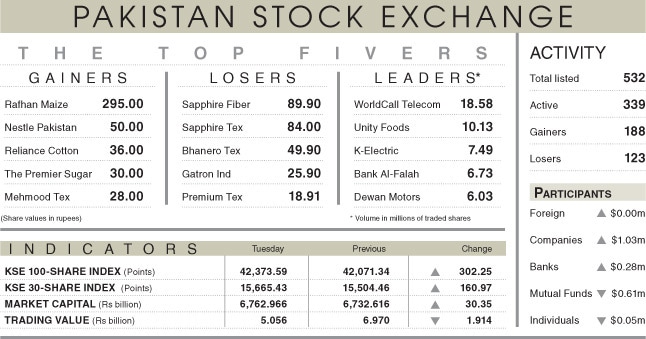

As a result, the KSE-100 index settled at 42,373.59 points, up 302.25 points or 0.72 per cent from the preceding session.

The trading volume decreased 43pc to 139.2m shares while the traded value went down 27.5pc to $22.6m on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (18.5m shares), Unity Foods Ltd (10.1m shares), K-Electric Ltd (7.5m shares), Bank Alfalah Ltd (6.7m shares) and Dewan Motors Ltd (6m shares).

Sectors that contributed to the index performance were commercial banking (67.7 points), technology and communication (60.7 points), power generation and distribution (57.5 points), exploration and production (34.2 points), cement (28.5 points).

Companies registering the biggest increase in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs295), Nestle Pakistan Ltd (Rs50), Reliance Cotton Spinning Mills Ltd (Rs36), the Premium Sugar Mills Ltd (Rs30) and Mehmood Textile Mills Ltd (Rs28).

Shares that declined the most in rupee terms were Sapphire Fibres Ltd (Rs89.90), Sapphire Textile Mills Ltd (Rs84), Bhanero Textile Mills Ltd (Rs49.90), Gatron Industries Ltd (Rs25.90) and Premium Textile Mills Ltd (Rs18.91).

Foreign investors were net buyers as they purchased shares worth $0.55m.

Published in Dawn, November 30th, 2022