WHETHER it was the panic caused by the rupee’s free fall or someone came across an ad while watching a video on YouTube, the State Bank of Pakistan (SBP) has finally woken up to the reality that global trading apps are a huge hit in the country. In a press release issued on May 18, it moved to ban all such platforms saying that they are not regulated and warned Pakistani residents of prosecution under the Foreign Exchange Regulation Act of 1947.

“Examples of such products include but are not limited to foreign exchange trading, margin trading, contract for differences, etc,” the central bank said. “It is clarified for the interest of the public that buying products and services being offered by the aforementioned platforms by any person resident in Pakistan is prohibited and against the laws of the land.”

Better late than never, I guess. From relatively sophisticated instruments like options to seemingly forex trading, these platforms target retail investors and lure them with a quick buck. Like this one ad on YouTube from OctaFX promoting — through some influencer obviously — its copy-trading app, which is “for people who want to achieve success in life but don’t have the time to learn.”

What’s interesting about all these apps is how they are almost exclusively targeting developing countries with the likes of India, Pakistan, Thailand, the Philippines and Indonesia accounting for most of the installs. For example, OctaFX explicitly asks for confirmation that you are not a US citizen while signing up, which by the way even needs a house address.

There is a strong appetite among average people to take exposure to various asset classes, even the riskier ones if given a simple and convenient platform which doesn’t require documentation for the past 10 years of their lives

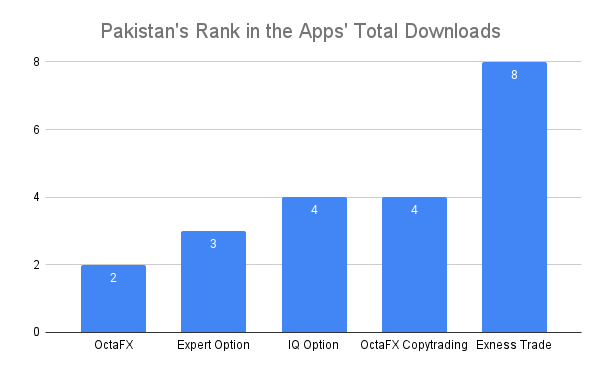

There are five such platforms in the top 50 of the finance category on Pakistan’s Google Play: OctaFX on 5, Expert Option at 19, Exness Trade 23, OctaFX Copy Trading 31 and IQ Option 50. So we can say they are popular, but how much? According to Appfigures estimates, OctaFX has been downloaded by over 5.3 million times since its release, IQ Option 3.1m, Expert Option 2.3m, OctaFX CopyTrading 0.57m and Exness Trade 0.26m.

Monthly downloads exhibit a particularly steep trajectory, especially for OctaFX, which has breached 100,000 consistently since August 2020. It crossed the half a million mark in April and stood at 337,500 as of May 19 — well above its monthly average of 82,876.

Pakistan’s share in the apps’ overall downloads

IQ Option comes in a distant second with average monthly installs of 48,577, followed by Expert Option at 35,943 and OctaFX CopyTrading’s 8,780. Obviously, these numbers don’t necessarily translate into users or transactions, but still give an idea about their scale. Of the overall downloads globally, Pakistan’s share ranges from a low of 4.2 per cent to a high of 22.6pc, ranking in the top 10 in all cases.

While it’s good the SBP has finally acted on the matter, the fact is these apps have been quite popular for years now. For example, IQ Option — the earliest of the lot — first hit 50,000 downloads all the way back in August 2017, as per Appfigures estimates which doesn’t have data before that year.

Contrast this with TikTok or PUBG (PlayerUnknown’s Battlegrounds), which posed such a serious threat to our culture and values that honourable courts had to intervene and ban them. Here, it’s only the public’s money at risk so a simple press release can suffice. Granted, it falls outside the mandate of the SBP to rule which apps can or cannot be on the Play Store. But what exactly has the Pakistan Telecom Authority been up to all this time? Don’t they love banning even the most benign of the stuff?

In any case, the popularity of these apps offers a valuable lesson to policymakers, industry, academia and business journalists alike who have long complained about the lack of investors in Pakistani financial markets. That there is a strong appetite among average people to take exposure to various asset classes, even the riskier ones if given a simple and convenient platform which doesn’t require documentation for the past 10 years of their lives. With proper awareness and marketing, this demand can be channelled to the regulated space and help some of the more structural issues facing our economy.

Published in Dawn, The Business and Finance Weekly, May 23rd, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.