KARACHI: A day after the ruthless bloodbath at the stock market that had seen the index in deep red, the bulls made a strong comeback on Tuesday to drive out the bears from almost all sectors.

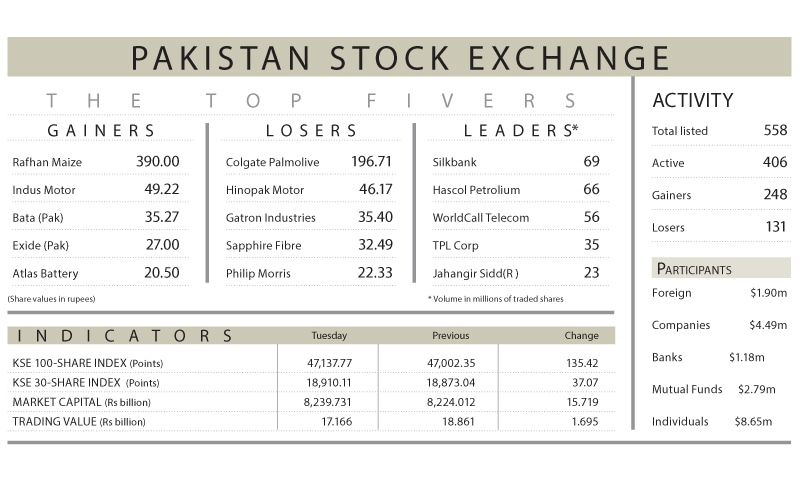

The KSE-100 index flew to intraday high by 506 points. It closed up by 135 points, or 0.29 per cent, at 47,138.

In early trade, investors took heart and were encouraged to buy at attractive levels as the traders were unanimous in the belief that the Federal Budget 2021-22 would sail through the lower house of parliament. The National Assembly passed the budget for the new fiscal year late afternoon by a majority vote after the speaker put it to voice vote.

However, the index could not sustain the high level and fell rapidly mainly due to massive selling of stocks by insurance companies worth $11.46m. A day ahead of the end of their financial year, insurance companies booked profit. Foreign investors also disposed of some holding after MSCI decision to demote MSCI Pakistan Index to Frontier Market from Emerging Market. Companies and banks accumulated stocks while individuals put liquidity to use by picking up mainly the second and third-tier stocks.

The trading volume fell to 581m shares from 655m shares the previous day. The investors activity in low-priced stocks was represented by the fact that nine of the 10 top-volume leaders were priced below Rs20 with Silkbank changing hands in 69m shares at Rs2 per share.

Technology (89 points), banks (71 points) and cement (22 points) sectors held the index high while losers were led by E&P (93 points), chemical (33 points), power (26 points).

E&P sector came in for massive battering. Among scrips, the technology share, TRG saw active buying to add 78 points to the index, in response to the corporate briefing held a day earlier. Other healthy performing stocks were Habib Bank Ltd; Engro Corporation; Unity and Meezan Bank Ltd.

Published in Dawn, June 30th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.