There has been a paradigm shift in the investment landscape. The old guard of specialist hedge funds and sophisticated long-only asset managers have been humbled by the hordes of retail investors taking over.

The wild gyrations in the stock price of Gamestop, a US-listed company, heralded this change, which has flipped the investment industry upside down. Instead of tracking Buffet, Soros and Lynch, now institutional investors are studying and following the trends of retail investors.

So what’s causing this true ‘democratisation’ of finance?

There are many reasons which are being put forward as an explanation for this new trend. In markets like the US, more than 60 per cent of the population already had investment accounts. In the UK, mandatory pension schemes force people to invest their pension savings in mutual funds or directly in stocks and bonds.

However, the traditional platforms were clunky. Difficult to open an account and tough and expensive to trade. For example, the average fees for trading a stock in the UK was £10-12 per trade (compared to £0.013 in Pakistan). New platforms such as Robinhood in the US and FreeTrade in the UK made it easier and lowered the friction in trading.

Some are also attributing part of the increase in retail trading to “cabin fever” induced by the lockdown.

People are getting bored sitting at home and stock trading keeps them busy. Along with that, people in many developed states got free money from the government as a part of the Covid stimulus. Stock trading is one of the most popular uses of Covid stimulus checks in the US (see data here).

I think besides this, another important factor that has fed into this trend is the popularity in Cryptoassets. While Robinhood was already launched by then, it is the crypto platforms such as Coinbase and Binance which made trading really easy and popular.

Bitcoin has become a “global” asset. These assets became equally popular, especially with young investors, regardless of their geography. This is very different from stock investment.

Traditionally, especially with institutional investors, there was always a very strong “home bias”. French funds invested in French stocks, US in the US and German in German companies. I saw that pretty closely when French investors used to tell me that Gemalto will dominate mobile payments and beat Apple and Google, since people trust Gemalto more. Germans loved Wirecard.

The boom in retail investments is not just unique to the US. Almost in every major stock market, there are similar trends. Each market has a local trading app that is gaining scale. In Brazil, there is XP, in India Zerodha, in Germany Flatex, in the Netherlands DeGiro (now merged with Flatex), in Japan SBI and Freedom Holding in Russia. East Money in China is larger in market capitalisation than Credit Suisse!.

“The times they are a changin’,” as Bob Dylan would put it.

Pakistan is no different. Although retail investment penetration in Pakistan has been significantly low, even by regional levels, there is a massive shift happening. K-Trade is the most downloaded investment app in Pakistan with over 250,000 downloads. Today, it is ranked as the 5th most downloaded app in Pakistan in the finance category – higher than all the banks. There is no asset manager in the list of top downloads.

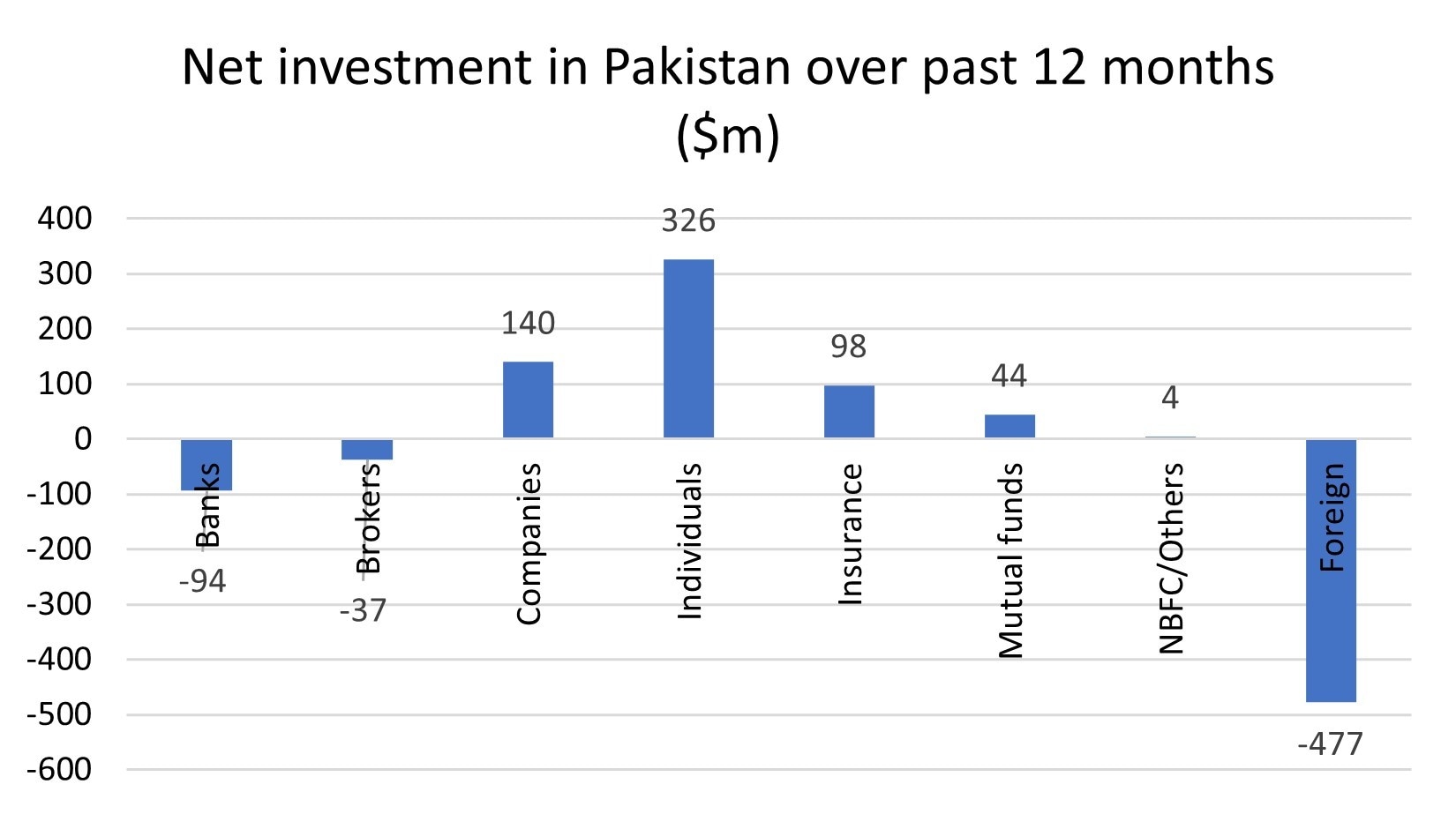

The chart above is using the data from NCCPL. It shows that Individual investors now account for 65pc of the trading volume on the Pakistan Stock Exchange. In comparison, global institutional investors only account for 5.5pc. Over the past 12 months, there has been an 11pc increase in the percentage share of retail investor volumes. The trading volumes from global funds have declined by 4.6pc. Individuals are the most important investors in Pakistan.

Not only are volumes of trading the most significant by individual investors but they are also the largest investors in terms of capital invested in the market. Over the past 12 months, individuals have invested a net amount of $326m in the companies listed on PSX. This number is almost 8 times more than the investment made by asset management firms.

Like in the US, sophisticated investors have been caught by surprise by the investment pattern of retail investors. Most institutional investors were invested in large companies in traditional sectors such as oil and gas, power and banks. The retail-led rally has been mostly noticeable in technology stocks and in cyclical sectors such as cement, steel and autos. Again, the pattern is not too dissimilar from the rest of the world.

Technology is changing most, if not all, industries now. Capital markets and investments are no different.

This democratisation of investment could be a very powerful force in building an inclusive society. The next stage will be that retail investors will start holding companies in which they have invested, becoming accountable for their social actions.

I believe that the next boardroom battles might not be limited to the likes of KKR (I recommend reading Barbarians at the Gate). Instead of protesting through the “Occupy Wall Street” movements, now they can buy shares and occupy boardrooms.

As a technology entrepreneur, I am preparing for interesting times in the capital markets.

Ali Farid Khwaja, CFA, is the Chairman of KASB Securities. He lives in London with his wife and two daughters. He has worked in financial markets in the UK and Europe for over 17 years. He is an alumnus of Lums and was a Rhodes Scholar at University of Oxford.