KARACHI: Investors in equities continued to dump shares which saw the KSE-100 index spiral downwards to settle at the end of trading on Wednesday at 27,229 — the lowest in six years, since Mar 31, 2014.

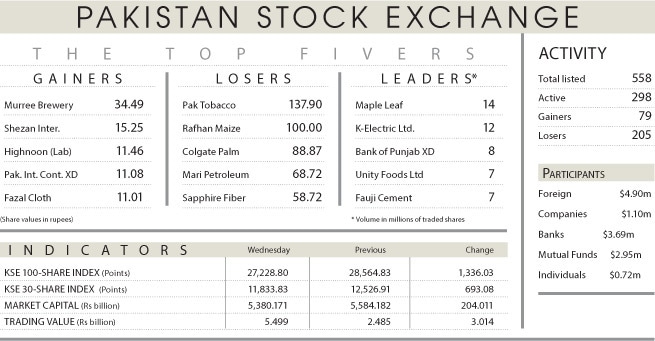

The index lost another 1,336 points (4.7 per cent), taking the current year-to-date collapse by 33.16pc.

The stampede to the exit door pulled the KSE-30 index down below the 5pc points decline by midday triggering the eighth trading halt since the rule came into force two weeks ago. Investors sold positions in stocks to seek the safety of the money market on surging dollar.

The market could not hide its disappointment as the government totally ignored the capital market in the stimulus package of the massive sum of Rs1.13 trillion. Investors stared in disbelief at the press release of the Ministry of Finance that showed a ‘nil’ against the item “Support to Capital Markets”.

Market was widely expecting the launch of a Rs30bn support fund. Research analysts also attributed the drop in the index to the lack of market-related relaxations which the industry looked forward to such as in case of Capital Gains Tax.

Some consolation was derived on the SBP announcement of a second cut in the benchmark policy rate by 150 basis points to 11pc, a week after lowering it by 75bps. It saw the market open in the positive and climb to intraday high by 222 points, before the index came crashing down.

Foreigners continued to leave by selling shares of $4.90 million which were picked up by companies, banks, insurance and individuals. Sectors contributing to the performance included banks, dipping by 430 points, cement 149 points, exploration and production 132 points, fertiliser 108 points and power 100 points.

Cement and banking were the major losers where Lucky lost 7.5pc, DG Khan 7.4pc, Maple Leaf 7.4pc, Pioneer 7.5pc, Habib Bank 7.5pc, Bank Alfalah 7.5pc and United 7.5pc all closed at their respective lower locks. E&P followed suit with Pakistan Petroleum declining 5.3pc and Oil and Gas Development Company 4.6pc closing in the red.

Published in Dawn, March 26th, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.