The PTI administration has proposed a budget for the next fiscal year that is designed to contract the economy, targeting a growth rate of 2.4pc — the slowest pace at which the economy will expand in a decade — to put it back on the road to stabilisation.

For many, even this low growth rate target for 2019-20 is a little optimistic given the unfavourable economic conditions. But then next two years are not for reviving economic growth or investment but for stabilising and documenting the economy, the high cost of which will have to be paid by everyone, especially the salaried and fixed-income groups.

The main idea of the budget is to decrease the country’s burgeoning debt through expenditure cuts and massive tax revenue mobilisation of Rs5,555 billion, up by about 34pc from the expected actual collection by the Federal Board of Revenue (FBR) this fiscal year, reduce the current account deficit by making imports expensive and rebuild depleting foreign exchange reserves. The impact of the similar but slightly less painful stabilisation policies implemented in piecemeal fashion during the present fiscal year are already showing the intended results as growth has decelerated to the nine-year low of 3.29pc and current account gap reduced significantly.

The focus should be on reducing dependence on imported intermediate goods that are used in producing finished products where viable

Like growth, the target for tax collection also appears ambitious given the fact that the FBR hardly appears to be up to the job in a thriving economy let alone in the periods of economic contraction.

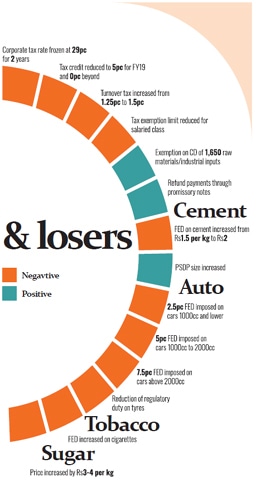

Apart from impacting on the lower- to middle-class households, the budget will affect the industry in many ways, the withdrawal of the “no (sales) tax, no refund” facility under the zero-rated regime for the export-oriented industries being one of them. In order to slightly offset the impact of these measures, the government has nevertheless tried to offer some relief to the manufacturers through certain tariff and other concessions. (Industry, which contributes 20pc to GDP, grew by a paltry 1.4pc against the target of 7.6pc in the outgoing fiscal year with large-scale manufacturing contracting by 2.06pc. Large industry is the key to boosting export-based growth.)

The major incentives for the manufacturing include removal of customs duty on more than 1,600 raw materials and industrial inputs and exemption from customs duty for machinery parts and accessories used by the textile industry. In addition to that, it has slashed customs duty on certain other items used as input by the local industries. Tax credit will be offered to the industrial employers on hiring fresh graduates.

The corporate income tax has been left untouched at the existing 29pc even if it has not been cut and it is proposed to change the status of the FBR Refund Settlement Company (Pvt) Ltd as a public company incorporated under the Companies Act 2017 so that the securities issued by it may be traded in order to facilitate exporters.

Moreover, the government feels that the measures announced to regulate the real estate market, a sector widely used to park and launder untaxed and illegal money, will force diversion of investment in the productive assets, particularly in the manufacturing sector.

At the same time, tax credit of 10pc available to a corporate industrial undertaking investing in purchase of plant and machinery for the purpose of expansion, balancing, modernising and replacement at any time between July 1, 2010 and June 30, 2021 has been halved and time period curtailed to June 30, 2019. This step is likely to affect several investors who had planned these activities in the next two years.

In the face of the challenges facing the economy, argues former Paapam chairman Syed Nabeel Hashmi, the budget is not as bad as was being feared by the industry even though he doesn’t expect any new investment in the manufacturing at least in the next two years.

“The steps like abolition of duty on raw material imports, maintenance of corporate tax rate the present level and tax credit on hiring graduates will help the industry survive through the slow-growth period and consolidate without big losses.” However, he said the government needs to enforce fiscal discipline, reform bureaucracy, document the economy, and bring transparency in its affairs if it wants the industry and citizens burdened by taxes to also contribute to ongoing stabilisation efforts.

Others agree, insisting that the chances of fresh investment in the economy will be hard to attract in the present conditions. “With policy interest rate already at 12.25pc, energy prices billed to spike in the next few months, and the demand in the domestic and international market contracting, who will want to invest in capacity expansion or new projects,?” asked Anjum Nisar, former president of the Lahore Chamber of Commerce and Industry.

He agrees that the government has withdrawn sales tax exemption to exporters under the zero-rated regime because it is being used by some to hide their local sales to avoid payment of tax, but added the exporters are not opposed to the proposal in principle.

“The issue is that no one trusts the government because it delays the payment of export refunds. On top of that the exporters cannot get their tax refunds without greasing the palms of the FBR babus. Everyone will accept the government decision if it introduces an automatic and efficient system of refund payments, reimbursing 75pc of the refunds through banks upon issuance of the attested copy of Bill of Lading and the remaining against the export proceeds after 30 days.”

At the end of the day, the government’s ability to meet its budget target or even getting closer to achieving them will depend on how much trust gap it can close with the business community as well as the citizens.

Published in Dawn, The Business and Finance Weekly, June 17th, 2019