THE IMF is in town again to negotiate a programme with the government. The discussions will no doubt centre on how to close Pakistan’s massive fiscal and external financing gaps, which are driving both inflation and exchange rate depreciation.

In this context, it is helpful to quantify these gaps, as well as identify the least-cost measures to close them, given that there are no easy options on the table.

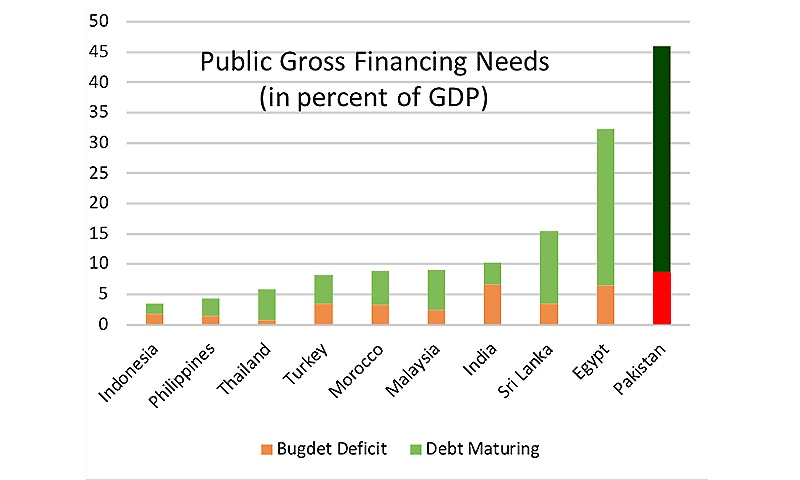

The fiscal gap first. At almost 80 per cent of GDP, Pakistan’s public debt is projected in 2020 to be among the highest among emerging market comparators. But the real problem is the associated public gross financing needs, which in 2020 will be 46pc of GDP, by far the highest among comparators, and more than three times the IMF’s 15pc of GDP high-risk threshold for emerging markets.

Driving these outsized financing needs is our 9pc of GDP budget deficit in 2020 (as projected by the IMF). This is the largest among comparators, and 5pc of GDP higher than the government’s own 4pc of GDP limit set in the Fiscal Responsibility and Debt Limitation (FRDL) Act, 2005.

The strategy outlined here has the potential to deliver medium-term breathing space for the government.

In principle, this adjustment could be accomplished via cuts in core government expenditure, but there is less fat here than is generally believed. Government pay in Pakistan is not generous; social and development spending is already at critical levels (as are our human development indicators); and the military budget appears off-limits due to ongoing border tensions.

What is left is add-on spending: losses of state-owned enterprises; and subsidies (eg petroleum, energy, sugar). The former will require layoffs and higher user prices; the latter will involve further tariff increases and tougher action against pilferage. While not easy politically, the government can ill afford to bear these largely regressive handouts anymore.

Much of the adjustment burden will still need to fall on revenues. Given our notoriously narrow tax base, the IMF will likely demand the elimination of tax exemptions, and serious measures to dent tax evasion. This will pit the government against the entrenched interests of the agricultural and real-estate sectors, self-employed professionals and small businesses, and even some established industries. Again, these are tough, but long-overdue and necessary reforms.

But fiscal consolidation will not be enough. Much of Pakistan’s public gross financing need is due to its short (two-year) maturity of debt: amortisations in 2020 are projected at 37pc of GDP, just under half of the total debt stock. To bring these down to reasonable levels, the government may have to consider reprofiling its domestic, and even some of its external, debt. Then, in the medium term, a strategy should be instituted to durably maintain an average debt maturity of at least five years. This will be far more effective than any limit on the level of debt-to-GDP ratio, as in the FRDL.

Turning to external financing, the calculus is even more daunting. On current policies, Pakistan’s cumulative current account deficit over 2019-2023 is projected at about $60 billion. Including external debt amortisations of about $40bn yields a medium-term external financing requirement of $100bn, a third of Pakistan’s GDP.

Pakistan does not have any material foreign exchange buffers to meet this requirement. Recent support from Saudi Arabia and the UAE was short term, so it will not help close the medium-term gap. In these circumstances, the IMF will likely demand full exchange rate flexibility, to help reduce the current account deficit. But this will not be without costs: currency depreciation will raise inflation (weakening our competitiveness), as well as the burden of servicing external debt. Thus, even if necessary to stabilise foreign exchange reserves, further exchange rate depreciation may not bring much net benefit in terms of reducing the external financing gap.

This means some sort of a rescheduling of external debt obligations will likely be needed. While the breakdown of the $40bn external debt amortisation is not known, the information in the IMF’s 2018 First Post-Program Monitoring Report suggests that about half of it is likely to be owed to official bilateral creditors (with China in the lead, followed by Saudi Arabia, the UAE and the Paris Club). If all of these creditors agreed to reschedule their claims by five years, it could save the government $20bn in foreign exchange reserves over the life of the IMF programme.

We can further assume that half of the remaining $20bn is owed to multilateral institutions and half to commercial creditors. Multilaterals will not be receptive to a rescheduling request, but, with an IMF programme in place, they should be able to provide new financing in excess of the amounts falling due to them. One would think they could provide net financing of about $10bn.

This leaves the debt to commercial creditors. Because of its relatively small size, it may not be worth renegotiating this debt (the market disruption caused by initiating a renegotiation may outweigh the benefit of any debt relief obtained).

However, official bilateral creditors may still reasonably demand that private creditor exposure is maintained during the Fund programme. In this context, the Pakistan government would be well advised to examine the successful debt exchange undertaken by Mongolia in March 2017 just after its staff-level agreement with the IMF.

The strategy outlined here has the potential to deliver meaningful medium-term breathing space for the government, and liberate it from living on the edge. It would also benefit the creditor community as a whole, as its claims on Pakistan would have a better chance of being repaid over the medium term. But, most importantly, it would ensure fair burden-sharing of the required adjustment between the government, its taxpayers, and its creditors; the IMF itself has adopted this mantra in recent years.

Faced with difficult decisions, the Pakistan government, as well as the IMF, would be well advised to be seen as being as equitable as possible by key stakeholders.

The writer teaches economics at SOAS, University of London, and is a senior research fellow at Bloomsbury Pakistan.

Published in Dawn, May 2nd, 2019