We need social enterprises along with commercial bodies to respond more effectively to the demands of development, with real structural changes so that the poor can access the market in the same way the rich do, argues Hilda Saeed

Years ago, in 1974, Dr Muhammad Yunus, economics professor in Bangladesh, met a group of poor village women while he was out on an evening stroll. He asked if they could improve their lot with a little capital. The women agreed that they could set up a small business. So began Grameen Bank, with the grand sum of $27, from Dr Yunus’s personal funds.

By the 1990s, micro credit financing had taken on like wildfire in Asia, Africa and Latin America. Prominent in Bangladesh and India, it emerged a little late on the Pakistan map. This industry has contributed to social revolution throughout the world, including Pakistan.

Dr Yunus’s aim was ‘capitalism with a human face’, and that is exactly what each such effort aims to achieve. It has contributed to economic development, created jobs, provided financial stability, and alleviated poverty, especially for women, including at the village level.

Players in the microfinance field include Kashf Bank, Tameer Microfinance Bank, First Women’s Bank, the National Rural Support Programme, with its various provincial and area branches, and the Pakistan Poverty Alleviation Fund. The recently established National Microfinance Network provides linkages amongst the various credit institutions, skills training and basic management know-how.

This initiative has seen remarkable development taking place. Roshaneh Zafar of the Kashf Bank says, “Women in Pakistan don’t get the acknowledgement they deserve for their contribution to the overall economy. All people want better lives for their children, their families and themselves. Empowering women comes through economic empowerment, education and health and investing in their social status… we aim to build a world free from gender discrimination.”

Both Kashf Bank and Tameer Microfinance Bank have excellent credit ratings. Their facilitation of micro credit and its impact on economic progress are expected to continue. Grameen Bank, for instance, is now entirely self-financed, using only the capital generated by its members; Pakistan can, with encouragement, achieve similar success.

Micro credit aims to become a substitute for informal expensive credit. It generally requires no collateral, has simple operational procedures and easy, flexible repayment plans. It facilitates group interaction, and even provides funds to those in need in case of emergencies, and is targeted at the most deprived sections of society.

This industry has succeeded in reducing exploitation of the poor by moneylenders, and provides loans at lower interest. A distinct advantage is that it empowers women within the household, enabling them to have greater decision-making power within the family and the community. Another plus point: it gradually improves living standards on a sustainable basis.

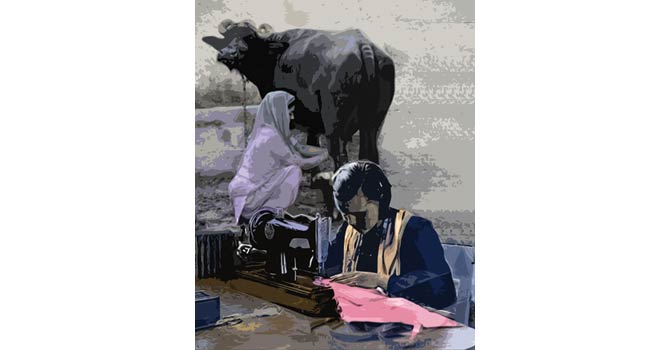

Thousands have benefited from microfinance schemes, using these to establish small businesses for everything from kitchens supplying large clienteles, small grocery or paan shops , jams and jellies manufacture, livestock breeding, tailoring, stitching and sewing institutes, silk weaving, etc.

Two success stories are illustrative of the trend: a woman had only one spindle to spool thread, which she packaged for sale. With Kashf Bank’s help, she was able to expand her work; today she employs seven women, and her husband has even given up his work to manage her business.

Another is that of the micro credit award winner Kishwar Sultana, who was deserted by her husband. Not to be defeated, she set up her own kitchen, supplying food to individuals and offices. She now caters for parties and office luncheons too, and has an expanding catering business.

Microfinance is the sector that has the largest potential clientele base of 6.5 million poor households, but because it is an underdeveloped area, it currently serves only seven to eight per cent of these potential clients.

Why hasn’t microfinance become big business? Why does it remain limited to small projects? Microfinance is an excellent initiative, but the problems that arise are those of corruption, inefficiency, lack of basic management or other necessary skills. Sometimes, little encouragement is available for new entrants to the world of small businesses.

Nor can the pitfalls be swept aside, 2010 saw a wave of suicides in Andhra Pradesh, India, for instance, which has the highest proportion of micro credit institutions in the world. More than 30 people who had recourse to micro credit killed themselves, because they could no longer meet credit repayments. (Danielle Sabai, Asian left observer). People are exposed to temptations which may lead them away from the real motive of micro financing—investing in small business.

Afshan Suboohi of Dawn’s business section has a thoughtful take on the subject, “Microfinance has not been entirely successful because achieving social objectives through commercial organisation is difficult... the hurdles are both administrative and structural.

“Administratively, low levels of awareness lead to lack of documentation; there’s non-availability of collateral within this group, to mitigate the risk of default, high handling costs by banks. At times, records may be faulty or incomplete,” she says.

However, with greater encouragement, social enterprise can expand more finance movement in Pakistan, but microfinance can be a tricky proposition for purely commercial enterprises. Its operational cost is higher than in the corporate sector and lack of skill support and weak management by the banking sector result in widespread default.

This is one reason why five big banks in Pakistan are inactive in this segment, despite the demand and need. Banks aren’t obligated to choose the most desirable projects over the most profitable ones.

Yes, we need social enterprises along with commercial bodies to respond more effectively to the demands of development, with real structural changes so that the poor can access the market in the same way as the rich. Poverty can be eliminated, but not without more official encouragement and facilitation, which are keys to success in microfinance.