KARACHI: In contrast to the global bullish trend in world stock markets following the inauguration of Donald Trump as the 47th president of the United States, Pakistani shares declined on Tuesday due to aggressive selling triggered by proposed changes to tax laws.

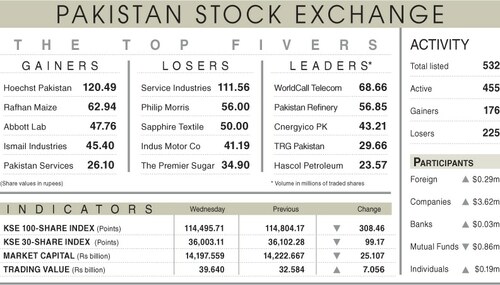

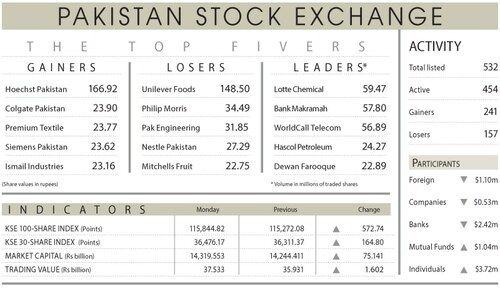

Topline Securities Ltd reported that the benchmark index started the day on a positive note, reaching an intraday high of 116,425 points. However, mid-session profit-taking caused the index to close at 115,042 points, resulting in a loss of 803 points, or 0.69 per cent, from the previous day.

The brokerage house observed that the tax changes may impact a small segment of non-filers participating in the stock market.

The primary drivers behind the negative movement included Mari Petroleum, Hub Power, Oil and Gas Development Company, Lucky Cement and PSO, which collectively wiped out 543 points. Ahsan Mehanti of Arif Habib Corporation said investor concerns over dismal growth projections, speculations over the government-PTI talks, and expectations over cautious SBP policy rate cut dampened investor sentiments.

Ali Najib, Head of Sales at Insight Securities, said the selling headwinds at and above 116,000 level took away early gains.

“Market vibes are suggesting that the profit-taking-cum-selling was driven by institutions including pension and mutual funds as they opted to do some restructuring ahead of the upcoming Monetary Policy Committee meeting,” he believed.

Banks and mutual funds turned net sellers as they offloaded shares worth $3.56m and $0.58m, respectively.

The trading volume, however, rose 23.66pc to 767.67 million shares while the traded value decreased 15.0pc to Rs31.82bn day-on-day.

Stocks contributing significantly to the traded volume included Cnergyico PK (114.03m shares), Bank Makramah (69.47m shares), WorldCall Telecom (64.22m shares), Fauji Cement (53.69m shares) and Citi Pharma Ltd (23.40m shares).

The shares registering the most significant increases in their share prices in absolute terms were Hoechst Pakistan (Rs121.84), Rafhan Maize (Rs94.94), Sapphire Fibres (Rs66.93), Pakistan Engineering Company (Rs61.02) and PIA Holding Company [B] (Rs49.68).

The companies registering significant decreases in their share prices in absolute terms were Unilever Foods (Rs299.49), Khyber Textile (Rs43.88), Ismail Industries (Rs34.54), Sazgar Engineering Company (Rs33.38) and Lucky Cement (Rs31.48).

Published in Dawn, January 22nd, 2025