KARACHI: Amid growing criticism of harsh taxation measures from the business community, opposition, and even treasury benches in the parliament, the stock market on Monday came under pressure, snapping a four-day post-budget winning streak as investors indulged in profit-taking.

Ahsan Mehanti of Arif Habib Corporation said the market fell sharply lower on dismal current account data. The country posted a $270 million deficit in May after three surpluses in the preceding months of the outgoing fiscal year.

He said tough tax measures announced in the budget 2024-25, especially bringing the exporters into the standard tax net, depressed market sentiments. He added that concerns about the unresolved Rs5.3 trillion circular debt crisis and uncertainty about the rollover of $15bn dues to the Chinese IPPs contributed to the bearish close.

Topline Securities Ltd said the banking sector witnessed selling pressure, as United Bank, Meezan Bank, Bank Al-Habib, Bank Alfalah, and Faysal Bank negatively contributed 345 points to the index.

Hub Power continued its positive momentum as its subsidiary Mega Motors Company entered into a new line of business in electric vehicles with BYD Auto Industry Company Ltd.

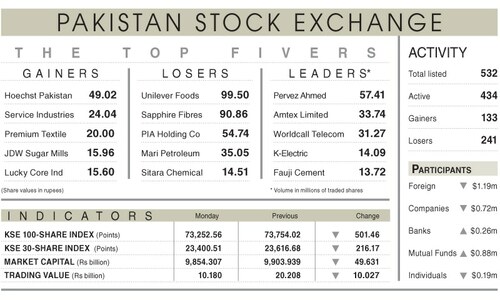

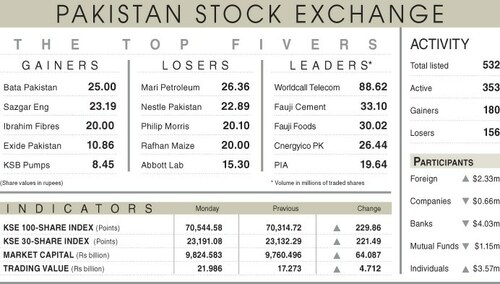

As a result, the benchmark index hit an intraday high at 79,388.12 points and a low of 78,167.43. However, the index settled lower after losing 578.40 points or 0.73pc on a day-on-day basis.

The overall trading volume dipped 18.28pc to 385.17 million shares. The traded value also plunged by 24.54pc to Rs15.45bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pervez Ahmed Co (46.84m shares), WorldCall Telecom (20.76m shares), The Hub Power (20.11m shares), JS Bank Ltd (16.86m shares) and K-Electric (15.74m shares).

The shares registering the most significant increases in their share prices in absolute terms were Nestle Pakistan (Rs112.27), Bhanero Textile (Rs55.41), Sapphire Textile (Rs34.77), Unilever Foods (Rs29.51) and Shield Corporation (Rs22.56).

The companies registering significant decreases in their share prices in absolute terms were Mehmood Textile (Rs52.41), Bata Pakistan (Rs24.64), Millat Tractors (Rs21.52), Shahmurad Sugar (Rs20.93) and Premium Textile (Rs20.58).

Foreign investors turned net sellers as they offloaded shares worth $0.35m.

Published in Dawn, June 25th, 2024