Bears dominated the Pakistan Stock Exchange (PSX) on Tuesday and dragged its benchmark index down sharply by 953 points by the day’s end.

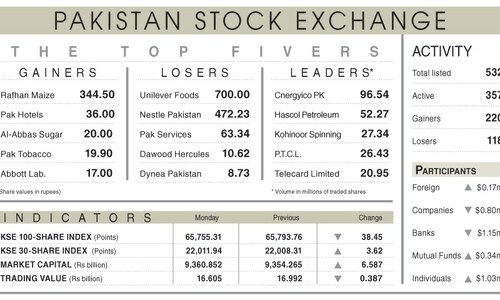

The KSE-100 index dropped by 953.60 points, or 1.45 per cent, to stand at 64,801.70 from the previous close of 65,755.30. It had reached a low of 64,64.66.

Finally, the index closed at 64,801.70 points, contracting by 953.60 points from the previous close.

Yesterday, the index had closed in the red despite flirting with the 66,000 mark and remaining positive throughout the day, which analysts attributed to concerns about expected tough talks with the International Monetary Fund (IMF) for the new Extended Fund Facility and the uncertainty about monetary policy direction in the upcoming review on March 18.

Awais Ashraf, director of research at Akseer Research, attributed the decline to investors being cautious about the IMF talks scheduled to start this week, led by the newly appointed Finance Minister Muhammed Aurangzeb, “who has described this year as a tough financial period”.

Additionally, he said that “the onset of Ramazan has also intensified inflationary pressure, as evidenced by the Sensitive Price Index (SPI) data, reducing the probability of a rate cut in the upcoming monetary policy”.

Shahab Farooq, director of research at Next Capital Limited, noted that the stock exchange “witnessed profit-taking today with reducing expectations of a rate cut by MPC next week”.

Furthermore, he highlighted “the possibility of tough actions demanded by IMF for a new loan facility as meetings with the IMF staff are scheduled to begin soon”.

Abdul Azeem, head of research at Spectrum Securities, noted that the index experienced a substantial decline primarily because of selling pressure stemming from the survey results which implied the SBP will maintain the policy rate at 22pc.

Furthermore, he added the reduced participation of investors in the market owing to the shorter trading time in Ramazan schedule also contributed to the bearish trend, coupled with the IMF releasing their schedule with the announcement to reach Pakistan tomorrow.

Dear visitor, the comments section is undergoing an overhaul and will return soon.