KARACHI: The share market on Thursday extended the overnight rally in mixed trading amid growing clarity on the political front.

The benchmark KSE 100-share index hit an intraday low at 61,460.45 losing 98.71 points and a high of 61,952.10 gaining 392.94 points.

Topline Securities Ltd said the buying momentum can be attributed to consensus with regards to the formation of a new government where PMLN and PPP agreed and informed about the upcoming coalition setup.

Resultantly, technology, bank and fertiliser sectors contributed positively to the index as System Ltd, Meezan Bank Ltd, TRG Pakistan, Engro Fertilisers and United Bank cumulatively added 367 points to the index’s performance.

Ahsan Mehanti of Arif Habib Corporation said the political stability outperformance of Pakistan’s sovereign dollar bonds and the second cut in profit rates on savings schemes boosted market sentiments.

The country’s international bonds maturing in 2031 enjoyed the biggest gains on Wednesday, up 2.7 cents on the dollar, at 61.7 cents, according to Tradeweb data. The 2026 notes were up 2.6 cents to 76.95 cents.

He added that a strong earnings outlook and rupee stability also fuelled optimism about the market’s future direction.

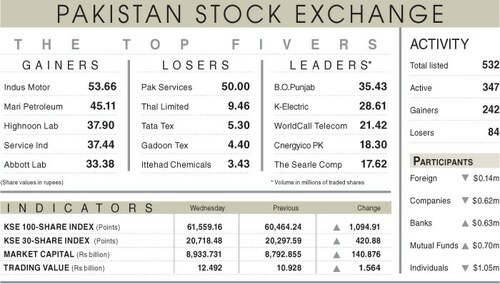

As a result, the KSE-100 index closed at 61,914.34 points after adding 335.19 points or 0.58 per cent from the preceding session.

The overall trading volume fell 10.45pc to 324.83 million shares. The traded value, however, rose by 11.79pc to Rs13.96bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pak Elektron (23.11m shares), Cnergyico PK Ltd (21.24m shares), Pakistan International Bulk Terminal (16.25m shares), K-Electric (16.20m shares) and TRG Pakistan Ltd (13.54m shares).

Shares registering the biggest increases in their share prices in absolute terms were Service Industries Ltd (Rs29.56), Systems Ltd (Rs23.03), Sazgar Engineering Ltd (Rs21.45), Mari Petroleum Ltd (Rs12.22) and Honda Atlas Cars Ltd (Rs10.26).

Companies registering the biggest decreases in their share prices in absolute terms were Indus Motor Company Ltd (Rs82.07), Reliance Cotton Spinning Mills Ltd (Rs43.12), Mehmood Textile Mills Ltd (Rs29.13), Highnoon Laboratories (Rs21.51) and Faisal Spinning Mills Ltd (Rs14.52).

Foreign investors turned net buyers as they bought shares worth $2.28m.

Published in Dawn, February 23rd, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.