KARACHI: Trading on the stock exchange commenced on a positive note in the outgoing week fuelled by the contraction of the trade deficit by 42 per cent on a year-on-year basis to $5.3 billion in the first quarter of 2023-24.

Arif Habib Ltd said the expectation of robust financial results for the first quarter of the ongoing fiscal year kept the stock market participants’ interest alive. Urea and DAP sales witnessed a jump of 11pc and 68pc, respectively, in September on a year-on-year basis.

Furthermore, cement despatches in the same three-month period reported an increase of 23pc on an annual basis. Moreover, cut-off yields of three-month treasury bills and three-year Pakistan Investment Bonds (PIBs) witnessed a decline of 29 basis points and 15 basis points, respectively, in the auction held in the outgoing week.

Inflation climbed up to 31.4pc in September. Meanwhile, the ongoing decline in international oil prices and a consistent appreciation of the rupee against the dollar eased some of the investors’ concerns about inflation. The rupee closed at 282.69 against the greenback after appreciating 1.8pc from a week ago.

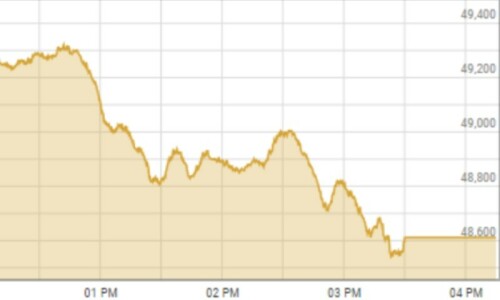

As a result, the benchmark index of the stock market closed at 47,494 points after gaining 1,261 points or 2.7pc from a week ago.

Sector-wise, positive contributions came from commercial banking (413 points), fertiliser (281 points), cement (176 points), power (81 points) and technology (77 points).

Meanwhile, sectors that contributed negatively were exploration and production (48 points) and miscellaneous (14 points).

Scrip-wise, positive contributors were Engro Fertilisers Ltd (108 points), Engro Corporation Ltd (102 points), Habib Bank Ltd (95 points), MCB Bank Ltd (89 points) and Meezan Bank Ltd (79 points).

Negative contributions came from Mari Petroleum Company Ltd (23 points), Pakistan Petroleum Ltd (17 points), Pakistan Services Ltd (16 points), Pakistan Tobacco Company Ltd (seven points) and Adamjee Insurance Company Ltd (six points).

Foreign selling clocked in at $12.05m versus a net purchase of $0.19m a week ago. Major selling was witnessed in commercial banks ($8.86m) and “other sectors” ($2.61m). On the local front, buying was reported by banks ($13.61m) and companies ($2.1m).

The average daily volume arrived at 291m shares, up 44pc from a week ago. The average daily value traded settled at $26m, up 15pc week-on-week.

According to AKD Securities Ltd, the stock market’s performance is expected to be significantly influenced by the upcoming review of the loan programme by the International Monetary Fund scheduled for November.As for the political landscape, announcing the exact dates for the elections will be a positive development for the stock market. Upcoming inflation readings and current account data will remain in the limelight, it added.

Published in Dawn, October 8th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.