Stocks suffered losses for the fifth straight session on Thursday, bleeding more than 1,700 points on the back of rumours of a hike in interest rates, economic uncertainty, and the unrelenting depreciation of the rupee.

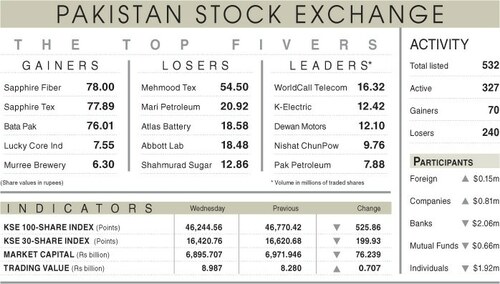

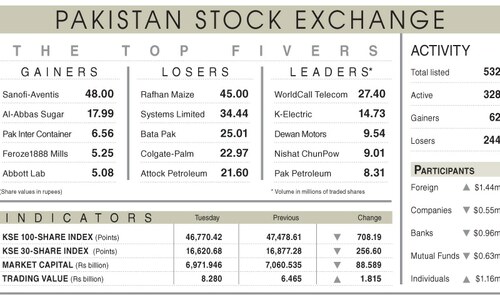

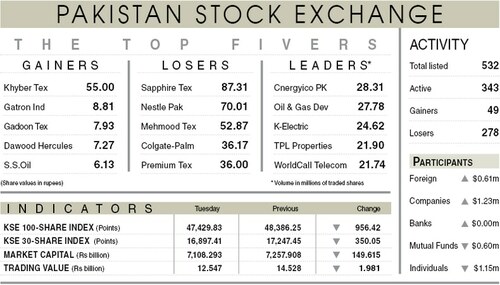

The bourse stayed flat for 10 minutes after the opening bell. However, at 9:40am, the market began its gradual slide with the KSE-100 eventually losing 659 points by 12:00pm, sinking to 45,584.62. After 2:50pm, the market plunged steeply — by 1,784.93 points — to reach a low of 44,459.62. When trading closed, it corrected itself to 45,002.41, down 1,242.14 points, or 2.69pc from the previous day’s 46,244.55.

The last time the market plunged so sharply (by over 1,500 points by day’s end) was after then-prime minister Shehbaz Sharif’s announcement of a 10pc “super tax” on large-scale industries in June 2022.

Intermarket Securities’ Equity head Raza Jafri told Dawn.com that the KSE-100 continued to be under severe selling pressure owing to a lack of confidence emanating from a weak economy, particularly the depreciating rupee.

“While value buyers may return if the dip extends, meaningful valuation rerating needs clarity to return,” he added.

Arif Habib Corp analyst Ahsan Mehanti echoed Jafri’s viewpoint, saying stocks fell across the board on economic uncertainty amid a slump in the rupee and a likely hike in interest rates owing to high inflation.

“The caretaker finance minister’s assertion of a lack of fiscal capacity to give relief on power bills and concerns for unresolved circular debt crises in the power sector played a catalyst role in [yesterday’s] bearish close,” he said.

The market had witnessed a sharp drop after rumours circulated that the State Bank of Pakistan was set to convene an emergency meeting in which it is expected to raise interest rates by up to 300bps, noted JS Global in its daily report.

KASB Securities chairman Ali Farid Khawaja told Dawn.com that investor sentiment “is very fragile”. “Any comment around political instability worries the market,” he said.

However, in Khawaja’s view, the bearish trend “will be short-lived” as he expects the market to recover. “We have seen similar volatility in the past as well.” He said reports of the Saudi crown prince’s visit to Pakistan “should be a strong catalyst for investor sentiment”.

Yousuf M. Farooq, director of research at Chase Securities, said market sentiment has changed over the last few days because of the anticipation of a rate hike.

“The market is expecting higher rates on changing expectations for inflation on the back of a continuously sliding rupee, higher oil and electricity prices and an anticipation of second-round impacts.”

He added that higher interest rates mean a higher cost of capital and cheaper stock prices.

“The market on the other hand is extremely cheap when compared to other crisis-ridden countries. The PSX is trading at three-four times earnings and earnings, dividends and buybacks have remained robust.”

Investor Jibran Sarfaraz told DawnNewsTV said a reduced inflow of dollars and the rumours circulating about an impending interest rate hike — by an expected 2 to 3pc — have resulted in the sell-off.

“You can see there is pressure on the market because of this, and the dollar [rate] is also increasing day by day which is creating problems for importers and investors are worried.”

He said until economic and political stability returns, “nothing can be done”.

Sarfaraz’s solution: controlling inflation and, by extension, the interest rate. “Whichever government comes to power should focus on stabilising the dollar [and inflation]. The more interest rates stay high, the more investors will hesitate.

“Unless the interest rate eases, investors won’t come because they’re getting 22-23 pc interest rates [by stowing their money in banks]. They will move where the higher profit margin is higher.”

Meanwhile, economic and business journalist Afshan Subohi highlighted predictability was crucial for any business to thrive.

“The capital market, in particular, operates and sustains on future expectations,” she told Dawn.com, pointing out that “current nervousness” in the PSX and the index dive manifested the fear for the future more than the current economic challenges.

“All relevant quarters including the current set of power yeilders need to be mindful of the fact that people and businesses are losing hope,” Subohi said.

She added that instead of inventing arguments to delay elections, efforts should be directed to hold polls in 2023 and ensure the peaceful transfer of power as quickly as possible.