KARACHI: The surging domestic debt servicing has left no option for the cash-strapped government but to borrow more amid higher spending and low revenue collection.

The government paid a whopping Rs3.107 trillion in domestic debt servicing during the first 9 months of the current fiscal year.

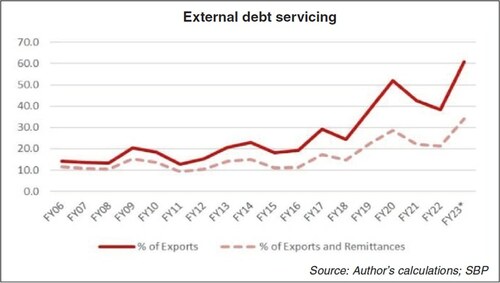

According to the latest report of the Ministry of Finance, the government spent an overall Rs3.582tr for both external and domestic debt servicing during the July-March period of 2022-23.

The volume of domestic debt servicing was 87pc of the overall total debt servicing.

However, the staggering increase in domestic debt has overburdened the government due to very expensive domestic borrowing at a rate of 22pc.

Costly domestic borrowings account for 87pc of the total in July-March

The government spent Rs3.582tr during 9MFY23 compared to Rs2.122tr in the same period of last year showing an increase of 69pc.

However, the increase in domestic debt servicing was obvious since the government has been borrowing at much higher rates from banks compared to the last year.

The rising inflation invited the attention of the IMF and the government was forced to increase interest rates but the inflation did not show any signs of easing and hit an all-time high exceeding 36pc in April.

Last Wednesday, the government raised Rs705bn through auctions of market treasury bills mostly at the rate of 21.99pc. Such a high return has created an attraction for cash particularly when banks are not ready for lending to the private sector.

Bankers said another big reason for the corporate sector to invest in the government papers was extremely poor activity in the property and construction industries.

At the same time, the overall economy has sharply fallen to grow with an estimated half per cent in FY23 which means cash has limited options to earn profits.

This high-interest rate of 21pc resulted in very high debt servicing. The IMF has once again reportedly asked Pakistan to increase interest rates to counter the ever-increasing inflation. The trade and industry leaders have already rejected the prevailing interest rate as they find it impossible for any business to sustain it.

Budgetmaking is now a tough task for the government facing pressure from IMF to increase the interest rate, reduce expenditure to curtail fiscal deficit, withdraw more subsidies to improve revenue and impose more taxes to collect higher revenues.

The next budget is considered an election budget and the PDM government is willing to provide some relief to win votes but the IMF is going tough as the country needs another loan agreement for the next fiscal year.

Published in Dawn, May 7th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.