KARACHI: The cost of fuel for electricity generation in November went down by more than one-third to Rs5.99 per unit from a month ago, according to data recently released by the National Electric Power Regulatory Authority.

A 27.1pc reduction in the cost of coal-based electricity contributed to the overall drop of 33.6 per cent in the average fuel cost in November, according to Tahir Abbas, head of research at Arif Habib Ltd.

The per-unit cost of coal-generated power dropped from Rs17.61 in October to Rs12.84 in November, thanks to the addition of power plants that operate on Thar coal. Local coal isn’t benchmarked to the international prices and is, therefore, significantly cheaper than its global counterpart.

Similarly, the average cost of re-gasified liquefied natural gas (RLNG) also dropped 16.2pc on a monthly basis, which helped bring down the overall cost of fuel for electricity generation in November.

Long-term RLNG contracts under which Pakistan imports gas from Qatar are benchmarked to Brent, one of the indices reflective of oil prices in the international market. A drop in Brent has indirectly led to a reduction in Pakistan’s import bill for natural gas.

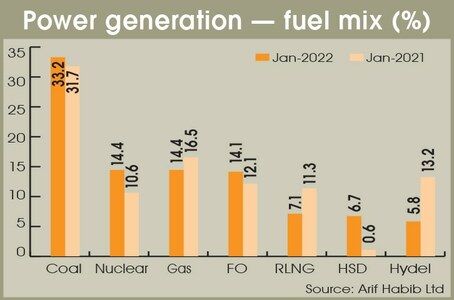

The share of imported gas in the national power mix was 12.1pc in November, down 45.1pc from a month ago.

Almost three in every 10 units of electricity in November were generated by hydel resources, which have effectively zero cost. However, the number of hydel-sourced electricity units produced last month was 21pc lower than a month ago because of the reduced flow of water in rivers.

Nuclear power also helped curtail the overall generation cost in November. Its per-unit rate stayed flat month-on-month at Re1.07. Its share in the power mix increased to 27.9pc from 20.6pc a year ago.

Even though the cost of furnace oil-based power declined 28.2pc month-on-month to Rs24.18 per unit, the fuel was still the most expensive among all sources. No wonder its share in the power mix was nominal last month.

The unviability of furnace oil for power generation is reflected in the fact that local refineries are increasingly faced with “ullage” constraints. Storage tanks of local refineries are full of furnace oil as relevant power plants lie idle. The cyclical issue has caused temporary shutdowns in at least one of the five refineries.

Published in Dawn, December 20th, 2022