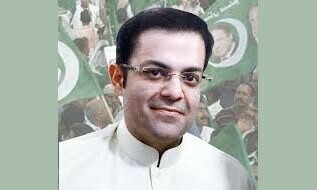

LAHORE: A special court (central-I) has ordered the National Bank of Pakistan (NBP) to attach 13 more accounts of the companies owned by Suleman Shehbaz, a son of Prime Minister Shehbaz Sharif, who is a proclaimed offender in a Rs16 billion money laundering case registered by the Federal Investigation Agency (FIA).

A written court order issued about Sept 7 hearing into the case reveals that the investigating officer submitted details of 13 bank accounts of various companies reflected against the identity card of Mr Suleman.

The companies include Al-Arabia Sugar Mills, Ramzan Sugar Mills, Chiniot Power Limited, Sharif Feed Mills and Unitas Steel Mills.

In his order, Presiding Judge Ijaz Hassan Awan observes that since Suleman Shehbaz is still at large and has not surrendered before the court, therefore, in addition to his moveable and immoveable properties, these 13 bank accounts are also attached.

The judge also issues show cause notices to the officials of different banks not complying with an earlier order about attachment of the accounts owned by two other proclaimed offenders (POs).

“Since concerned authorities of the banks have failed to comply with the orders of this court through IO, show cause notice is given to them with the direction to show cause as to why they be not proceeded under the law for non compliance of the orders of this court,” says the judge.

The judge also summoned the bank officials on Sept 17 when the FIA prosecutor would also come up with the reply of the prosecution to the petitions of PM Shehbaz and his son Hamza, seeking acquittal in the case.

In this case, the court had already confirmed the interim pre-arrest bail of Mr Shehbaz and Hamza.

The FIA had booked Mr Shehbaz and his sons Hamza and Suleman in November 2020 under sections 419, 420, 468, 471, 34 and 109 of the Prevention of Corruption Act, read with section 3/4 of the Anti-Money Laundering Act. The trial court had granted interim bail to Mr Shehbaz and Hamza on June 21, 2021, a day before their first appearance before the FIA.

Published in Dawn, September 11th, 2022