KARACHI: The rising trend of remittances reversed in July when a decline of 7.8 per cent was recorded compared to the same month of the previous fiscal year, according to the data released by the State Bank of Pakistan (SBP) on Tuesday.

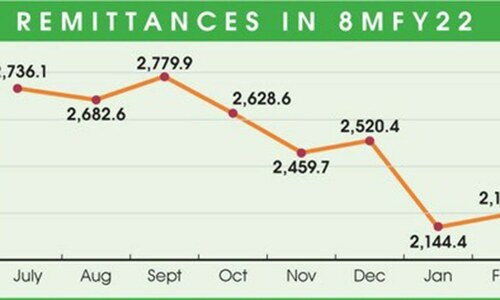

The country received $2.523 billion in July FY23 compared to $2.736bn in July FY22, the SBP reported. The country received over $31bn in remittances in the previous fiscal year, a record high. Remittances increased by 18.4pc in June when compared to May.

The SBP said that the workers’ remittances recorded an inflow of $2.5bn during July 22, continuing their record streak of above $2bn for 26 consecutive months.

The increasing trend of remittances continued in FY22 while the new fiscal year started with a decline in remittances. Many reasons are available for this decline.

The SBP’s data shows that remittances from almost all important destinations, with the exception of the United Kingdom (UK), declined.

In terms of growth, during July 2022, remittances decreased by 8.6pc on a month-on-month and by 7.8pc on a year-on-year basis. “This decrease largely reflected the lower number of working days in July as a result of Eid, at 17 working days compared to 22 last month and 18 in July 2021,” the SBP said.

Pakistan’s reliance on remittances for its foreign exchange has been increasing each year, despite record inflows and record exports in FY22. The import bill for FY22 for goods and services was about $84bn, which created a large trade gap and a current account deficit of $17.4bn.

This large amount of remittances, about $31bn in FY22, could not bridge the trade gap, resulting in the huge current account deficit. The policymakers slashed imports to bring a balance in trade and control the damage on the external front of the economy by minimising the current account deficit.

The massive drop of about 48pc in imports in July was not welcomed by the industry and the All Pakistan Textile Mills Association representative announced an expected decline of about $3bn in textile exports in FY23.

As a damage control measure, the government has been struggling hard for the last four months to get the International Monetary Fund (IMF) loan resumed. The finance minister announced that about $4bn has been arranged, a precondition for the IMF to get approval at the board meeting scheduled to be held in the last week of August.

The SBP data shows that the highest amount was remitted from the Kingdom of Saudi Arabia but was still 12pc less than in the same month of FY22. The remittances from the Kingdom were $580.6 million for July. Media reports suggest that Saudi Arabia is ready to keep $3bn in the SBP’s account to support the dwindling foreign exchange reserves of the central bank. In the past, Saudi Arabia supported Pakistan in the same way.

The second highest inflow of remittances was from the United Arab Emirates, which was about $456m, but it also fell by 16.7pc compared to the same month of last fiscal year.

The remittances from the UK, which is the only important destination for remittances, noted an increase of 3.4pc as the inflows rose to $411.7m.

The European Union countries were the fourth important destination for remittances, as they remitted $294m in July despite a decline of 2.2pc compared to the last year.

Other important sources of remittances were $254m from the United States of America and $280.6m from other Gulf Cooperation Council countries.

Published in Dawn, August 17th, 2022