KARACHI: The benchmark index of the stock market took a plunge on Tuesday as investors resorted to profit-taking on inflation concerns.

Activity on the main board remained dry whereas hefty volumes were recorded in third-tier stocks, said Arif Habib Ltd. The prime minister’s statement about the harsh conditions imposed by the International Monetary Fund also led to the worsening of sentiments on the bourse.

“Tough economic conditions let the market trade in a range-bound trajectory… the index moved in a range of 535 points,” said Topline Securities.

JS Global said investors should stay cautious in coming trading sessions and adopt a buy-on-dip strategy, particularly in banking and energy exploration and production sectors.

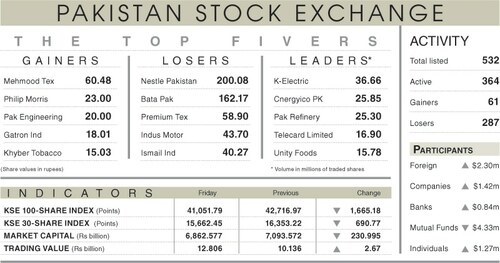

The KSE-100 index settled at 41,765.62 points, down 112.95 points or 0.27 per cent from a day ago.

The trading volume increased 3.7pc to 257.2 million shares while the traded value went up 4.5pc to $37.3m on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (28m shares), Oilboy Energy Ltd (23.89m shares), WorldCall Telecom Ltd (17m shares), Unity Foods Ltd (16.6m shares) and Cnergyico PK Ltd (9.8m shares).

Sectors that took away the highest number of points from the benchmark index included commercial banking (61.38 points), fertiliser (48.46 points), technology and communication (21.05 points), oil and gas marketing (19.63 points) and chemical (13.89 points).

Shares contributing most negatively to the index included Fauji Fertiliser Company Ltd (41.72 points), Bank AL Habib Ltd (20.9 points), Pakistan State Oil Company Ltd (14.83 points), Mari Petroleum Company Ltd (14.42 points) and MCB Bank Ltd (12.83 points).

Stocks that contributed most positively to the index included Lucky Cement Ltd (38.13 points), Nestle Pakistan Ltd (16.54 points), Pakistan Oilfields Ltd (16 points), D.G. Khan Cement Company Ltd (9.75 points) and Thal Ltd (9.64 points).

Foreign investors were net buyers as they purchased shares worth $0.49m.

Published in Dawn, June 29th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.